By Matthew Boyle

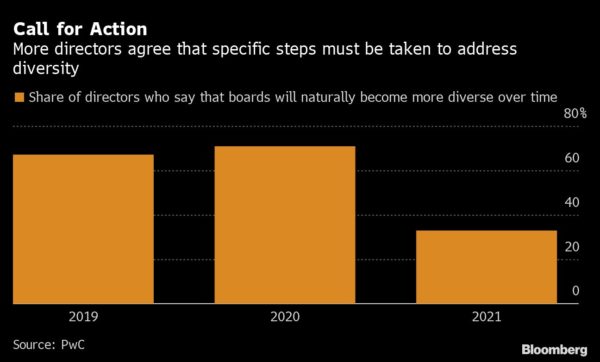

The share of corporate directors who say specific policies are necessary to make boards more diverse increased markedly over the past year, as more rules aimed at doing just that crop up across the U.S.

One-third of directors polled by professional services firm PwC said “no action” was necessary to achieve diversity on public company boards, down from 71 percent who said the same in last year’s survey. Nearly two-thirds supported stock-exchange listing rules requiring disclosure of board diversity, such as those Nasdaq Inc. recently implemented, and one in five favored laws that mandate minority directors, like the bill California passed last year.

The shift in directors’ thinking comes as they’re increasingly pressured to improve gender and racial diversity. Investors such as BlackRock Inc. and Vanguard Group Inc. are voting against members of non-diverse boards, and the new California law fines companies that don’t comply. The percentage of new Black directors on Fortune 500 boards almost tripled in 2020 compared with previous years, recruiter Heidrick & Struggles found, but the boards of the nation’s largest companies are still overwhelmingly comprised of white men and women.

Skepticism about diversity efforts, specifically among male directors, is part of the problem, PwC’s survey of 851 directors found. One in three men on boards said the push for more diverse directors results in boards nominating “unqualified” and “unneeded” candidates. Less than 20 percent of female directors said the same.

“I’m very concerned about that statistic,” Tim Ryan, PwC’s U.S. chair, said in an interview. “When I see that it tells me we have work to do.” There’s little evidence that the increase in female directors has resulted in less competent boards.

Also, almost six in ten directors said diversity is driven by “political correctness,” an increase from the last two years’ surveys. And half of those surveyed said shareholders are “too preoccupied” with diversity, a slight uptick from last year.

The new Nasdaq rule does not mandate any changes, but does require companies that don’t have women or diverse members to explain why. Adding to the pressure, U.S. Securities and Exchange Commission Chair Gary Gensler has said the SEC is exploring separate recommendations for company disclosures of diversity data. California requires boards based in the state meet gender and other diversity requirements. Its gender quota law will head to trial this month.

More stories like this are available on bloomberg.com.