By Claire Ballentine, Misyrlena Egkolfopoulou and Francesca Maglione

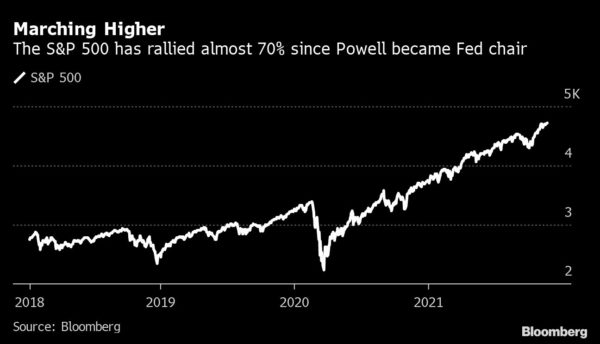

The man who helped rescue the U.S. stock market from the pandemic’s chaos is headed for another four years in office.

News that U.S. President Joe Biden selected Jerome Powell to serve another term as U.S. Federal Reserve Chair was met with relief across Wall Street. During the tumultuous previous two years, the Fed’s decisions to cut interest rates and its measures to support the economy helped the U.S. avoid a prolonged recession, earning Powell praise from both professional and amateur investors.

Now Powell, along with potential Vice Chair Lael Brainard, face new challenges: accelerating inflation, exacerbated by supply chain disruptions, and the need to eventually scale back some of the help it gave out during the worst periods of the pandemic.

The Fed chair’s main responsibilities are to keep prices stable, to guide decisions on when to raise or lower interest rates and to help as many people as possible become employed. So what the central bank does — and therefore Powell’s reappointment — affects almost every aspect of everyday Americans’ financial lives, from their homebuying goals to their retirement savings to the prices they’re paying for groceries.

Powell’s reappointment signals that easy monetary policy will continue, said Keith Lerner, chief market strategist at Truist Advisory Services. “It’s a positive for folks investing for retirement and for 401(k) plans,” he said. But the Fed chair is just one of the many factors that will affect markets and investments — “there’s also where Covid trends go, where the economy goes, supply chain factors,” he said.

Here are a few of the areas that experts say will be affected — positively and negatively — by Powell’s reappointment.

Crypto and Risk Assets

In the past two years, high-risk investment assets like cryptocurrencies and unprofitable tech companies have seen their prices skyrocket. The reason? A combination of low interest rates, rising consumer savings and stimulus checks from the U.S. government.

For example, there are now two dog-themed cryptocurrencies with a theoretical market capitalization of more than $24 billion each. Meanwhile, the price of Bitcoin has almost doubled since the start of the year, and unprofitable electric vehicle company Rivian Automotive Inc. recently raised almost $12 billion in the year’s biggest initial public offering.

If Powell is slow to raise interest rates, investors will likely stay enthusiastic about risky bets like these.

There’s also an argument that cryptocurrencies can be a hedge against inflation, although the connection is far from clear. Proponents say that since digital coins have a limited supply, they can’t be devalued, unlike the U.S. dollar or other traditional currencies.

“For die-hard crypto bulls, another Powell term may provide some confirmation bias, since these investors often view crypto as a hedge for loose Fed policy,” said Mike Bailey, director of research at FBB Capital Partners.

But overall, there’s uncertainty about how markets are going to fare without additional support from the Fed, which will test retail investors’ portfolios, said Douglas Boneparth, president of wealth-management firm Bone Fide Wealth.

“That’s one of the major tools that’s been used to keep prices in the stock market,” he said. “When you take one of the crutches away to see if the economy can walk on its own, investors are going to find out just how durable their portfolios are.”

Real Estate

Low interest rates during Powell’s tenure helped encourage consumers to take out mortgages and buy homes. That, along with a lack of supply, has catapulted the real estate market higher, and his reappointment might help keep the housing realm hot.

“I would expect a lower-for-longer interest rate expectation to be bullish for home prices since mortgage rates would remain well below historical levels,” FBB’s Bailey said.

It’s good news for those selling homes and for those involved in real estate businesses, but makes it more difficult for buyers, especially those looking for their first home. In September, the share of people who think now is a good time to buy a home fell to 29%. The last time Americans were that pessimistic on the housing market was in 1982, when the average 30-year fixed rate mortgage was more than 15%, compared with about 3% now.

But Greg McBride, chief financial analyst for Bankrate, expects rates for credit cards, home equity lines of credits, and other consumer and small business loans to move higher, as the Fed inevitably raises interest rates. He recommends that homeowners refinance their mortgages now, when rates are still low.

“As we move into 2022, pay down that high-cost debt, because when we get to the back half of the year, that cost of debt is likely to increase even more once the Fed starts to raise interest rates,” he said.

Inflation

Looming large over the American consumer right now is inflation, with an index of consumer prices rising at the fastest annual pace in more than 20 years. That’s affecting a wide range of items from Dove soap to ice cream bars.

To counter that, the Fed may need to accelerate its timeline of raising interest rates, currently near zero. The central bank has already planned to reduce its bond-buying program — which has helped shore up the fixed income market — this month, and is expected to increase interest rates in June, according to pricing in interest-rate futures markets.

The rollback of monetary support could cause the stock market to take a dip, but experts say Powell’s clear communication with Wall Street’s pros and his cautious approach to making changes will help temper the damage.

“If the economy continues to improve, rates will move up regardless of who the Fed chair is,” Truist’s Lerner said. “The one thing with Powell is that he is more focused on maximum employment, and we think he’ll take a guarded approach and make sure he doesn’t hike rates too far too fast.”

However, some worry that Powell has underestimated the threat of inflation, and has over-attributed it to some current supply chain issues, instead of recognizing it as a lasting force.

“There’s a lot of thought that Powell has overshot on inflation, and he’s going to be dovish on inflation, but I think he’s a market participant unlike an economist, and he’s been through these cycles and I think that matters,” said Kim Forrest, chief investment officer at Bokeh Capital Partners. “As an investor that invests for other people, I’m very happy that they continued with Powell.”

McBride at Bankrate expects that the Fed’s measures to combat inflation will make for a more bumpy ride for the stock market in 2022. “From an investor’s perspective, just hang in there,” he said. “We’re bound to see more volatility in the course of the next 12 months or so, the returns are not going to come as easy as they have for the last year or so.”

He recommends “focusing on your long-term goals and just regularly contributing and making sure that you’re invested appropriately for your goals and risk tolerance.”

Retirement and 401(k) Plans

In the very short term, confirmation that Powell will serve a second term helps the stock market avoid any kind of meltdown over a new Fed chair who could immediately shift the central bank’s direction or introduce unfamiliar and unexpected policies.

While stocks rose only modestly Monday after the news, market analysts say the announcement is likely to support equities moving forward, given traders are familiar with Powell and know his plans and goals for the economy from past news conferences and announcements.

“If Powell means more continuity and less uncertainty, everyday investors may feel less risk aversion as they consider putting more money away in the stock market for retirement savings,” said FBB’s Bailey.

For Boneparth at Bone Fide Wealth, Powell as chair is a positive for financial planners and the accounts they manage. “We kind of know what this means for your portfolio,” he said. “Status quo usually leads for an easier conversation with clients.”

More stories like this are available on bloomberg.com.