By Danielle Moran

Bankers in the $4 trillion municipal-bond market should prepare for a busy 2022 with issuance that’s mostly expected to be on par or more than this year.

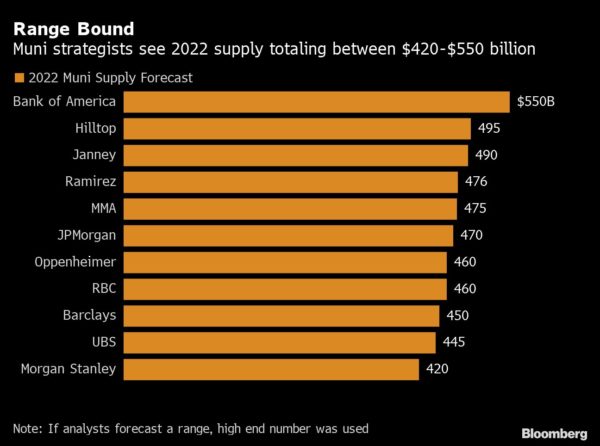

Sales forecasts collected from almost a dozen firms range from about $420 billion to $495 billion. A notable outlier is the projection from researchers at Bank of America, the market’s largest underwriter, who expect a record year of sales totaling $550 billion.

Averaging the 11 forecasts show municipal issuers are expected sell about $470 billion of bonds next year.

States and local governments have sold about $422 billion of long-term debt so far this year, plus another $20 billion sold with corporate identifiers with about three weeks left before the winter holidays. Including municipal-backed corporates, long-term sales are running at a pace about 5% below 2020, data compiled by Bloomberg show.

For much of the year, investors flooded funds that invest in state and local government debt on the outlook for higher taxes and comfort with the state of municipal credit buoyed by federal stimulus. Overall, investors added about $81 billion of new cash to municipal mutual funds, according to the Investment Company Institute.

The market would need about $475 billion of supply next year to meet current demand, according to Bloomberg Intelligence analyst Eric Kazatsky. His outlook is based on the latest muni-fund flows and bondholder reinvestment data.

Key Insights

- Bank of America municipal analysts see a record boom of upcoming sales with governments issuing $550 billion of bonds in 2022. Yingchen Li and Ian Rogow, co-heads of municipal research, said that governments’ balance sheets, flush with federal dollars, will permit them to sell more debt for infrastructure projects.

- That’s an opinion shared by Tom Kozlik, head of municipal research and analytics at Hilltop Securities. He said muni-bond sales are poised to “materially rise” next year as “a long-standing aversion to funding infrastructure and other key projects with municipal bonds will begin to abate.”

- Strategists at UBS led by Thomas McLoughlin and Kathleen McNamara estimate a “modest supply contraction” because issuers will have less need to sell debt because of strong finances and because there were fewer bond ballot measures approved by voters. The prospect of higher interest rates also could stymie refinancing sales, they said.

- The group said that total returns for investment-grade municipal bonds will be low, likely between 1% and 2% while those on high-yield debt should perform better.

- The federal infrastructure bill will be “constructive” for municipal supply, said Matt Fabian, a partner at Municipal Market Analytics. He expects sales to reach between $450 billion and $475 billion.

- “Governments will want to piggy back their own priorities onto projects being funded with federal dollars, and assuming the federal spending stabilizes or improves areas, it will encourage development, and development brings municipal bonds,” Fabian said in an email.

- Peter Block, a managing director at Ramirez & Co. said that because the new federal aid for infrastructure will be spent over the next five- to eight-years he doesn’t expect “any sea change” in the amount of bonds sold for public works projects. He forecasts $476 billion of total sales.

- Erin Ortiz, managing director for municipal credit at Janney Montgomery Scott, expects $490 billion of new sales bolstered by historically low interest rates and a bevy of infrastructure needs. She expects the debt will be well absorbed into the market.

- “The demand side is still very favorable,” she said in a interview. “If a government has a project they are perusing this is a good environment for them.”

- Charles Peck, head of public finance at Wells Fargo & Co., estimates new muni sales will be “flat to slightly up” in 2022 compared with this year. He said that governments may borrow for “ancillary infrastructure” projects like broadband and electric vehicles.

- Analysts at Morgan Stanley round out the low end of the forecasts, saying that debt issuance will total about $420 billion in 2022.

- “Decreased new money issuance may seem counterintuitive given increased federal infrastructure spending, but historically this hasn’t reliably boosted muni borrowing,” strategists Michael Zezas, Samantha Favis and Barbara Boakye wrote in a research note.

More stories like this are available on bloomberg.com.