By Rita Nazareth and Vildana Hajric

Stocks were on pace for their longest losing streak since September as prospects for higher rates and inflation unsettle global markets. Some corporate warnings about the negative impacts of the omicron coronavirus variant also soured sentiment.

The S&P 500 headed toward its fifth straight drop, while the tech-heavy Nasdaq 100 underperformed major benchmarks. Treasury 10-year yields rose to about 1.8%. Lululemon Athletica Inc. sank as the maker of yoga pants said omicron was constraining its operations. Torrid Holdings Inc. plunged after the plus-size women’s clothing retailer cut its sales forecast as the variant caused disruptions to its workforce.

Some of the most-speculative pockets of the market bore the brunt of the selling. Cathie Wood’s flagship ARK Innovation exchange-traded fund slid as much as 5.1%, bringing its five-day rout past 17%. GameStop Corp. and AMC Entertainment Holdings Inc. helped drive a basket of so-called meme shares to the lowest level in about a year. Bitcoin fell for the fifth time in six sessions, putting it on pace for its worst start to a year since the earliest days of the digital alternative to money.

Markets are facing higher volatility as the pandemic liquidity that has pushed equities to record highs is withdrawn. The Federal Reserve will likely raise rates four times this year and will start its balance-sheet runoff process in July, if not earlier, according to Goldman Sachs Group Inc. A key measure of U.S. inflation — set to be released Wednesday — is anticipated to have increased further in December, putting additional pressure on the central bank to tighten policy.

“The fact that the Fed might be looking to tackle inflation head on and adopt an even more-hawkish approach has caught the market a little bit off guard,” said Fiona Cincotta, senior financial markets analyst at City Index. “That’s being reflected in those high-growth tech stocks falling again.”

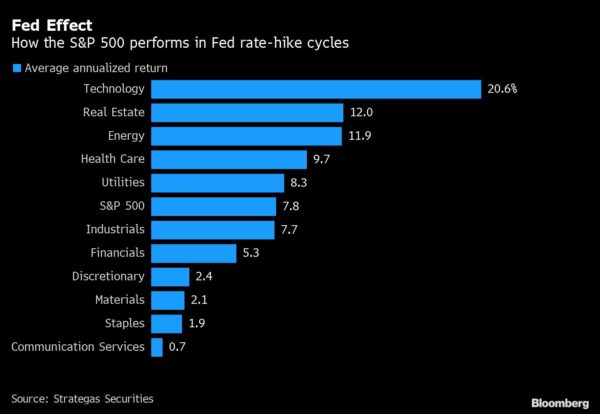

In the past three decades, there have been four distinct periods of rate-hike cycles by the Fed. On average, technology, which has been under pressure amid prospects of earlier and faster rate increases, is among the best-performing sectors during those cycles, according to Strategas Securities.

Here are some key events this week:

- Fed Chair Jerome Powell’s confirmation hearing in the Senate Banking Committee on Tuesday.

- Kansas City Fed President Esther George and St. Louis Fed President James Bullard discuss the economic and monetary policy outlook on Tuesday.

- EIA crude oil inventory report on Wednesday.

- China PPI, CPI on Wednesday.

- U.S. CPI, Fed Beige Book on Wednesday.

- U.S. initial jobless claims, PPI on Thursday.

- U.S. Senate Banking Committee hearing for Lael Brainard, nominated as Fed vice-chair on Thursday.

- Richmond Fed President Thomas Barkin, Philadelphia Fed President Patrick Harker,

- Chicago Fed President Charles Evans speak on Thursday.

- Bank of Korea policy decision and briefing on Friday.

- Wells Fargo, Citigroup, JPMorgan due to report earnings on Friday.

- U.S. business inventories, industrial production, University of Michigan consumer sentiment, retail sales on Friday.

- New York Fed President John Williams speaks Friday.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.4% as of 11:19 a.m. New York time

- The Nasdaq 100 fell 1.9%

- The Dow Jones Industrial Average fell 1.2%

- The Stoxx Europe 600 fell 1.4%

- The MSCI World index fell 1.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.3% to $1.1327

- The British pound fell 0.2% to $1.3566

- The Japanese yen rose 0.4% to 115.15 per dollar

Bonds

- The yield on 10-year Treasuries advanced three basis points to 1.79%

- Germany’s 10-year yield was little changed at -0.04%

- Britain’s 10-year yield advanced one basis point to 1.19%

Commodities

- West Texas Intermediate crude fell 0.2% to $78.71 a barrel

- Gold futures fell 0.2% to $1,794.30 an ounce

More stories like this are available on bloomberg.com.