By Prashant Gopal

The impatient and moneyed, trying to get ahead of expected increases in U.S. mortgage rates, are doing what it takes to win bidding wars for homes. That means going big.

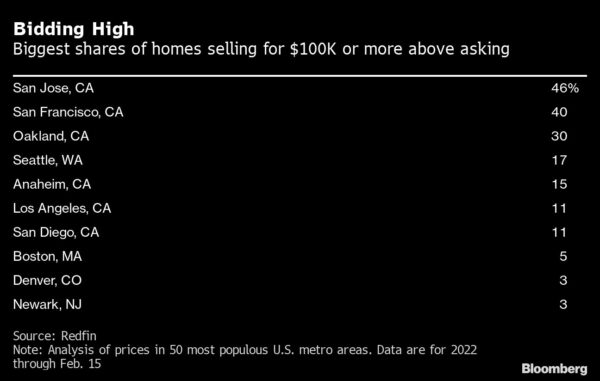

This year through mid-February, 5,897 homes sold for at least $100,000 above the asking price, up from 2,241 a year earlier, according to a report by Redfin Corp. In the San Jose, California, metro area, 46% of sale prices reached that threshold, a jump from 20%.

As the supply of listings dwindles, home shoppers’ concerns about overpaying are giving way to fear of missing out. While mortgage rates have dipped recently, they’re expected to climb again when the Federal Reserve increases its benchmark rate. Buyers worried about getting locked out of the nicest houses in the most expensive markets are rushing into purchases before borrowing costs head higher.

“People are willing to bid up home prices because they want to be done with their search,” said Sylva Khayalian, a Redfin agent in Los Angeles. “They’re anxious to purchase a home ASAP because as rates rise, they won’t be able to afford the homes they’re looking at now and they’ll soon have to drop into a lower price range.”

More stories like this are available on bloomberg.com.