By Finbarr Flynn

The worst losses in credit markets since the global financial crisis are likely over for now, as companies that loaded up on cash grow adept at navigating faster inflation and investors who yanked money from fixed income return.

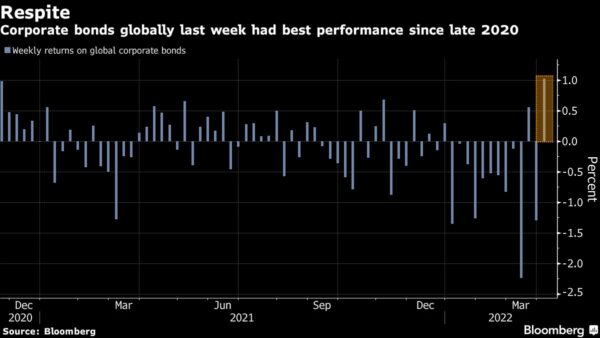

That’s the view of some of the more optimistic investors, who have taken heart from a recent rally. Bloomberg’s multi-currency corporate bond index recorded its best performance in more than 16 months last week. Still, it lost 7.1% in the first quarter, the biggest slump since 2008.

JPMorgan Chase & Co. analysts argue the rotation away from bonds into equities is likely to let up, with less selling in the second quarter. Elisa Belgacem of Generali Investments remains overweight on credit, and Deutsche Bank AG sees investment-grade spreads declining over 12 months.

“Credit looks in a reasonable state to weather this particular storm. With strong balance sheet cash positions and record-low default rates the case appears to remain fundamentally positive” for credit in developed markets, Christian Nolting, global chief investment officer for Deutsche’s private bank, wrote. “Bouts of technical selling pressure are to be expected, though, whenever risk sentiment sours due to the conflict situation or other factors like inflation spikes” and central bank action.

The war in Ukraine is expected to shave more than 1 percentage point off global growth this year and drive up inflation by a further 2.5 percentage points from already-high levels. Federal Reserve projections point to rate hikes through each of the remaining meetings in 2022.

Further complicating the picture for the bond market: The Fed plans to begin reducing its $8.9 trillion balance sheet sometime in the coming months.

Potentially in anticipation of a still higher cost of capital, issuers from around the world sold more than $229 billion of debt in the U.S. high-grade market in March, one of the biggest months on record, according to data compiled by Bloomberg.

On Monday, six companies borrowed in the U.S. high-grade market, including Credit Suisse Group AG’s sale of $2.5 billion of notes. Activity is also gaining pace in Europe, with East Japan Railway Co. and Blackstone Private Credit Fund among a raft of issuers announcing planned deals.

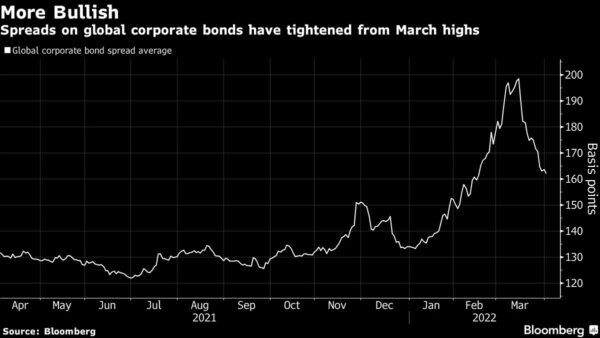

Average euro borrowing costs for high-grade firms eased to about 130 basis points. Spreads have tightened for three straight weeks after an extended run of widening that began in mid-January.

“Technicals should prove resilient in the near term, with flows stabilizing and high absolute yields attracting yield-sensitive investors back into the asset class,” according to Generali’s Belgacem. Still, “we expect a worsening in default rates in Europe.”

After a strong increase following the invasion of Ukraine, yield premiums on investment-grade dollar bonds have tightened for three consecutive weeks, a Bloomberg index shows.

But with an inverted U.S. Treasury yield curve flashing warning signs, Goldman Sachs Group Inc. strategists last week recommended that investors take advantage of the tightening in credit spreads to reduce risk and shift up in quality in high-yield notes.

They argue spreads have likely reached the lower end of their range and expect investment-grade yield premiums will widen to 123 basis points in the fourth quarter, compared with the 111 basis points on a Bloomberg index on Monday.

The Wall Street bank isn’t alone in that view.

“I am not so super bullish for the market,” said Holger Mertens, a credit portfolio manager at Nikko Asset Management who is focusing on relative value bets to boost performance. “I wouldn’t be surprised if we see the old wides again” of 145 basis points or higher.

Elsewhere in credit markets:

EMEA

The European Union is heading a busy day of debt issuance in Europe’s primary market, with at least 10.95 billion euros ($12.03 billion) of deals set to price marketwide, data compiled by Bloomberg show.

- The EU will price 6 billion euros of long 20Y green bonds at 9 basis points above midswaps, and inside an opening pricing target of about 11 basis points above swaps, after amassing more than 57 billion euros of investor orders for the sale

- Among corporates, Diageo Plc is returning to Europe’s market for new bonds for the first time in about a year and a half with an offering of two euro and two sterling bonds

- ESG debt pioneer Enel SpA has chalked up another ethical milestone with the largest offering of sterling sustainability-linked bonds. The Italian power firm raised 750 million pounds ($985 million) in a sale on Monday, the largest corporate sustainability-linked bond sale in the currency on record

- Elsewhere in ESG, a German market is introducing a new sustainable debt structure to boost transparency and encourage more smaller companies to dip their toes into the ethical space. The so-called ESG bridge structure intends to buoy sales of Schuldschein notes with ESG criteria, building a market where such debt accounted for more than a quarter of last year’s issuance

- The U.S. Treasury has halted dollar debt payments from Russian government accounts at U.S. banks, increasing pressure on Moscow to find alternative funding sources to pay bond investors

Asia

The dollar-debt primary issuance market was quiet on Tuesday with public holidays in China and Hong Kong. Two issuers from elsewhere in the region mandated for potential sales.

- Japan’s Orix Corp. and Freeport Indonesia mandated banks to arrange fixed-income investor calls from Tuesday, and benchmark-sized dollar bond offerings may follow

- Australia’s central bank opened the door to earlier interest-rate increases by scrapping its five-month reference to remaining “patient” on policy and signaling that upcoming inflation and wages data will be crucial to the timing of liftoff

- Sri Lankan bonds slumped after protests against soaring inflation and lengthy power cuts led to a cabinet reshuffle, adding to concern political turmoil will hamper the government’s ability to repay its debts in the face of a deepening economic crisis

Americas

Investment-grade companies are expected to sell $25 billion in new bonds this week.

- Scientific Games, owner of a portfolio of gaming products, is set to hold a lender call Monday for a $2.2 billion leveraged loan to refinance debt

- Barclays Plc is developing a global private credit strategy, according to several people familiar with the situation, seeking to take part in the fast-growing $1.2 trillion asset class

- U.S. credit ratings deteriorated last week as the main ratings companies issued 48 downgrades and 29 upgrades

- More than one hundred companies globally have either delayed or pulled financing deals since Russia’s invasion of Ukraine, including initial public offerings, bonds, loans and acquisitions

More stories like this are available on bloomberg.com.