By Paulina Cachero

The calculus on whether to rent an apartment or buy a home has gotten more difficult.

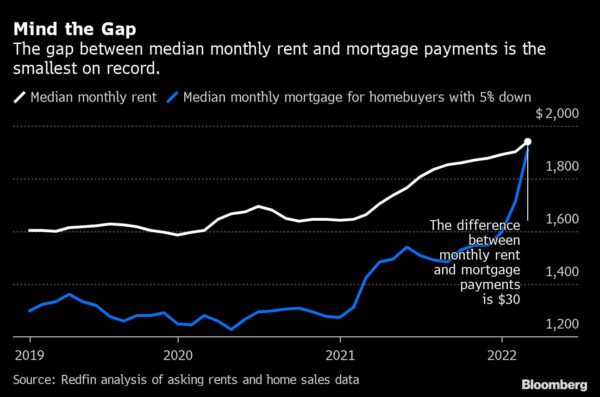

That’s because the difference between median monthly rents and median monthly mortgage payments in the U.S. has narrowed to just $30 — the smallest gap on record, according to the real estate brokerage Redfin.

Median monthly asking rents surged by 17% year-over-year to a record high of $1,940 in March. Still, the cost of owning is ballooning even more, as mortgage rates surge at the fastest pace in decades, according to Redfin. Median monthly mortgage payments shot up by 34% in the same period, clocking in at $1,910 for homebuyers with a 5% down payment.

Historically, mortgage payments are lower than rent, mostly because apartments are concentrated in high-priced cities such as New York and San Francisco while the lower value of homes in suburban and rural areas keeps monthly costs for owners down. But the gap has evaporated after the jump in borrowing costs.

The difference between rents and mortgage costs has been narrowing since the pandemic-driven surge in the housing market, falling from $322 in March of 2020. The trend has been most acute in metropolitan areas that also saw the fastest-rising rents.

It’s worth noting that mortgage payments often don’t factor in things like property taxes and utilities, which can push the cost of ownership even higher, according to Redfin chief economist Daryl Fairweather.

Many potential first-time homebuyers have been priced out of the market, forcing more people to choose between renting or moving to a city with a lower cost of living, Fairweather said. For cities like Miami, Austin, Texas, and Portland, Oregon, surging demand has been driven by the wave of remote workers on the hunt for houses. For traditionally pricey areas like New York, it’s been exacerbated by residents flocking back to the city after leaving during the pandemic.

For those who are in the market for a home, Fairweather recommends taking a “wait and see approach,” since the housing market is showing early signs of a cooldown and price growth may slow in the coming months.

“But, don’t wait too long because the housing market may accelerate again by this time next year, or two years from now,” she said.

More stories like this are available on bloomberg.com.