By Molly Smith

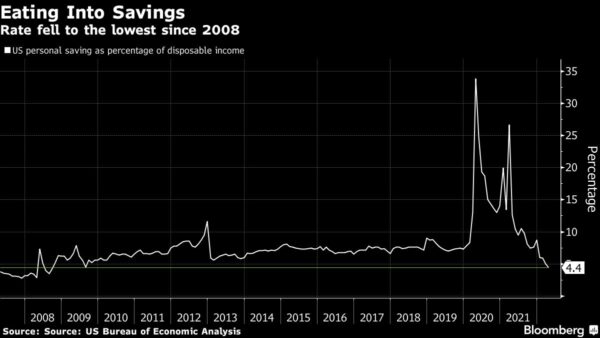

Americans are saving at the lowest rate since the onset of the global financial crisis, underscoring consumers’ willingness to spend even in the face of decades-high inflation.

The personal savings rate as a share of disposable income dropped to 4.4% in April, the lowest since September 2008, according to data from the Bureau of Economic Analysis released Friday. The report also showed that inflation-adjusted spending remained strong despite elevated, yet moderating price pressures.

Consumers so far appear to be largely undeterred by the highest inflation in about 40 years, eager to spend after pandemic-era restrictions. Americans are also putting more on their credit cards, and borrowing soared the most on record in March as everyday essentials become more expensive.

The spending binge is at risk of slowing as gas prices are now back at record highs and grocery bills are climbing, taking a bigger chunk out of household budgets. A separate report Friday showed US consumer sentiment fell to fresh decade low in May.

Younger Americans may be the most resilient of all. Gen Z and millennials are more likely than their older counterparts to travel this summer, according to a survey from Verasight commissioned by Bloomberg News.

The BEA figures also showed the personal consumption expenditures price index, which the Federal Reserve uses for its inflation target, rose 0.2% from a month earlier and was up 6.3% from April 2021. Both reflect a moderation from the figures in March.

More stories like this are available on bloomberg.com.