By Alex Tanzi

About two-thirds of American consumers who live paycheck to paycheck said they experienced at least one sudden income disruption — from losing a job to a serious illness or the birth of a child — in the past three years, according to a survey.

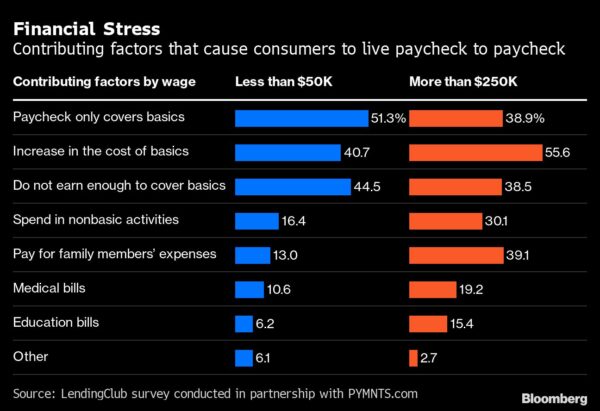

The findings highlight the financial insecurity faced by many households in the US, even among high earners. In the survey, a partnership of industry publication Pymnts.com and LendingClub Corp., consumers in the upper-income bracket often cited paying for a family member’s expenses as a driver of financial distress.

Skyrocketing prices for food, gas and homes in the past year have added to the uncertainty: Almost 45% of the respondents cite “dramatically increased” costs of housing, health care or other relevant expense as a reason why they have next to nothing left at the end of the month.

Triggers include natural disasters, lawsuits, retirement or death of a household member. But joyous events like a marriage or having a child can also move families into a precarious financial state.

Those living paycheck to paycheck are more likely to have lower incomes. Still, in the mid-May survey, a third of consumers earning at least $250,000 said they devote all of their salary to expenses, with little to nothing left over at the end of the month.

A separate survey conducted by CivicScience, a market research firm, found that the share of those “not satisfied” with the amount of money they earn has increased steadily over the past few months.

Since the monthly LendingClub survey started in March 2020, the share of households living paycheck to paycheck has ranged from slightly more than half to two-thirds.

The survey is based on responses from about 3,700 US consumers conducted from May 10 to May 23.

More stories like this are available on bloomberg.com.