A federal judge in California is expected to sentence Ramon Abbas to prison next month after the Nigerian Instagram star pleaded guilty to wire fraud charges last year. He amassed a reported net worth of $70 million through his schemes.

Abbas, known on social media as Ray Hushpuppi, pretended to be a Wells Fargo banker from New York named Malik two years ago in an attempt to grab funding from a Qatar businessperson, federal prosecutors said. The businessperson was seeking a loan in order to build a school in Qatar, authorities said.

Abbas, with the help of three other men from New York and New Jersey, defrauded the Qatar victim of more than $1 million. He pleaded guilty in April 2021.

Abbas’ case is being handled in California, where the FBI’s cybercrime unit is based. Court documents from the U.S. Central District Court in Los Angeles show that Judge Otis Wright changed Abbas’ sentencing date to Sept. 21. His sentencing date has been pushed ahead twice — once on Feb. 2 and again on July 11, court documents show.

Abbas is also connected to an indictment unsealed last year in which North Korean military employees attempted to hack into Sony Pictures.

Abbas’ attorney — Louis Shapiro of Los Angeles — didn’t immediately respond to a request for comment to Finurah. Abbas was arrested in the United Arab Emirates then flown to the U.S.

Abbas was arrested with 11 others in six simultaneous raids, according to The Guardian. Detectives seized more than 150 million dirham (about $40 million).

He faces up to 20 years in prison. Court documents show that Abbas, who has been in U.S. custody since 2020, was released from jail last month.

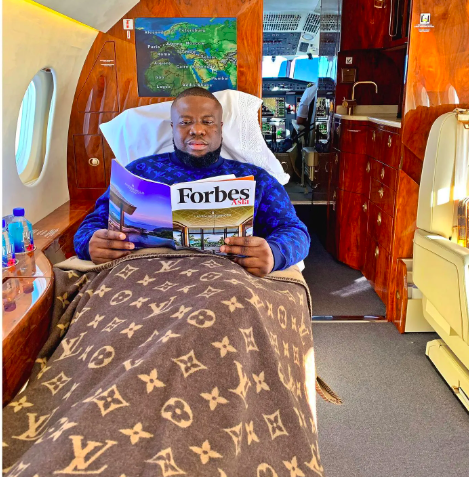

Abbas rose to social media presence after years of posting photos and videos of himself wearing designer clothes, flashing expensive watches and posing in luxury cars or jets, federal prosecutors said. Authorities said Abbas financed the lavish lifestyle through a transnational network of money laundering and business email compromise schemes.

Business email compromise, or BEC, scams are one of the largest growing cyber attacks in the U.S., authorities said. Between October 2013 and December 2021, about 116,400 Americans fell victim to a BEC scam and lost $14.7 billion, according to FBI data.

BEC scams have become so prevalent because they offer a criminal lofty rewards with very little skill to set one up, said Ahmad Salman, a cybersecurity expert and integrated sciences professor at James Madison University in Virginia.

“They are effective because, unlike other cybersecurity attacks such as malware, hacking, viruses, ransomware, they do not, in general, require programming or networking skills,” Salman told Finurah.

A typical BEC scam involves one person leading the charge who has hired a team of workers who send out fake emails to employees all over the world, Salman said.

“Paying these workers — and other expenses such as computers, electricity, internet — can be costly for the scammer,” Salman said. “However, just one successful fraudulent wire transfer from the victim to the attacker can cover these expenses for a year in most cases.”

Abbas was accused of schemes that defrauded a U.S. law firm of about $40 million, illegally transferring $14.7 million from a foreign financial institution, and plotting to steal $124 million from an English football club.

At his celebrity height, Abbas posted social media pics with Nigerian pop stars Davido and Wiz Kid along with English soccer players including Tammy Abraha, Bloomberg reported.

“His celebrity status and ability to make connections seeped into legitimate organizations and led to several spin-off schemes in the U.S. and abroad,” Kristi Johnson of the FBI’s Los Angeles office said in a statement last year.