By Ava Benny-Morrison and Chris Dolmetsch

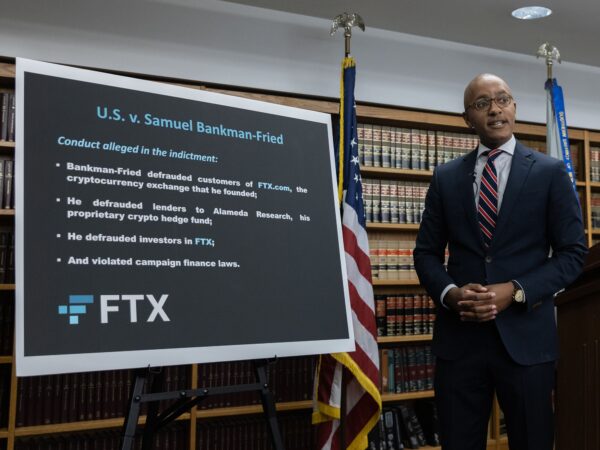

FTX cryptocurrency exchange founder Sam Bankman-Fried is responsible for “one of the biggest financial frauds in American history” and the investigation of the alleged scheme is “very much ongoing,” Manhattan US Attorney Damian Williams said Tuesday.

Bankman-Fried was charged with eight criminal counts, including conspiracy and wire fraud, earlier in the day, for allegedly misusing billions of dollars in customer funds to prop up his Alameda Research crypto fund. Bankman-Fried was arrested Monday in the Bahamas, where he was living.

While the 30-year-old Bankman-Fried may not fit the typical profile of someone who cheats investors, “you can commit fraud in shorts and t-shirts in the sun —that’s possible too,” Williams said during a press conference in New York. The alleged scheme involved “dirty money” that was “used in service of Bankman-Fried’s desire to buy bipartisan influence and impact the direction of public policy in Washington,” the federal prosecutor said.

“While this is our first public announcement it will not be our last,” Williams said.

Prosecutors claim Bankman-Fried used tens of millions of dollars of the proceeds for illegal contributions to political campaigns.

“He preyed on his customers, the victims of this case, abusing the trust placed in not only his company but himself as the lead of that company,” FBI New York Assistant Director in Charge Michael Driscoll said. “I want to be clear: this case is about fraud. Fraud is fraud.”

If convicted, Bankman-Fried could face as long as 20 years in prison for each of the wire fraud and money-laundering charges, and five years on each of the commodity and securities fraud charges and campaign-finance fraud, the US Department of Justice said in a statement. White-collar defendants, if convicted, rarely serve statutory maximum sentences.

The US Securities and Exchange Commission and the Commodity Futures Trading Commission sued Bankman-Fried separately on Tuesday for his alleged role in the collapse of FTX.

Since the inception of FTX in 2019, Bankman-Fried “began secretly and improperly diverting customer funds to his crypto hedge fund Alameda research,” SEC Enforcement Director Gubir Grewal said at the press conference. “Bankman-Fried’s house of cards began to crumble as crypto prices plummeted in 2022.”

The collapse shows that trading on a non-compliant trading platform poses risks for investors and doesn’t offer protections against fraud, Grewal said. “It’s imperative that non-compliant platforms come into compliance” with US regulators, he said.

“The runway is getting shorter for them to come in and to register with us, and for those who do not, the enforcement division stands ready to take action,” Grewal said.

Read More: Bankman-Fried Balks at Extradition as US Sketches Case for Fraud

–With assistance from Bob Van Voris.

(Updates with maximum sentences for alleged crimes.)

More stories like this are available on bloomberg.com.