By Kelsey Butler

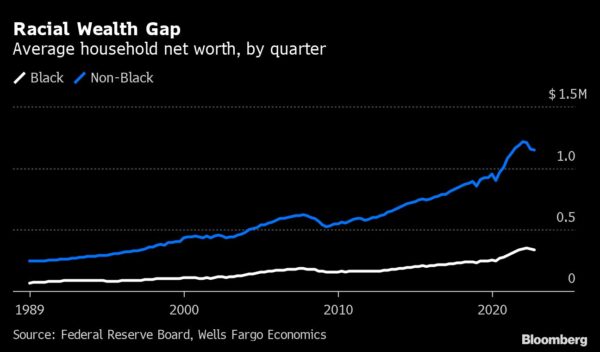

Black families are closing the US wealth gap, but still lag far behind other groups in net worth.

Since the end of 2019, the average net worth for Black households rose 32% through the third quarter of last year, according to a Wells Fargo & Co. report. That compares with a 21% increase for non-Black households.

Even with recent growth, Black wealth still trails in actual dollars: about $340,000 per household on average, compared to $1.1 million for their non-Black counterparts, per the report. The racial wealth gap — the legacy of slavery and systemic racism that excluded many African Americans from opportunities for financial advancement — could get worse for coming generations, researchers have said.

“The big takeaway is the Black and African American community has made headway relative to before the pandemic,” Jay Bryson, chief economist for Wells Fargo’s corporate and investment bank, said in an interview. “Directionally the improvement we’ve seen in the last three years is all positive, but when you still look at the absolute levels there’s still a pretty big gap there.”

Homeownership has contributed to recent gains. Buoyed in part by low mortgage rates, the percentage of African American homeowners rose to 45.2% in the third quarter of 2022, up from 42.7% three years earlier. It still lags far behind that of White households, however, at 75%.

Counterintuitively, a lack of asset diversification also helped bolster net worth, given the brutal losses for stocks in 2022. Corporate equities and mutual funds make up just 5% of Black household assets, compared to 24% for non-Black households.

A recession in the coming months may undo some of this progress, Wells Fargo warned. But demand for service jobs, where Black workers are typically overrepresented, could offset job losses in more sensitive sectors. And the labor market recovery for African American workers has been much quicker in this cycle than in the wake of the Great Recession, with the group seeing above-average wage gains after being hit hard in the early part of the pandemic.

More stories like this are available on bloomberg.com.