“Rip it, save half, and don’t look at the other half” is the advice Shaq gives to young people receiving their checks — a lesson he wishes he had learned.

In an interview with CNBC “Make It” during its Halftime Report, published on May 8, 2018, Shaq tells interviewer Bob Pisani at BTIG Commissions for Charity Day that saving more than half is the best strategy for accumulating wealth.

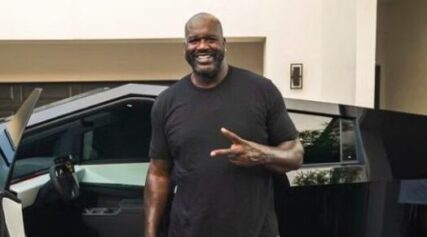

Shaq, whose net worth is estimated to be $400 million, used a piece of paper to illustrate how to save, tearing it in half and then into quarters for those seeking to become billionaires.

Shaq’s Money Lessons

“May I have a sheet of paper? Children, young guys coming into a lot of money, this is a $100. What you want to do is rip the $100 in half — $50, save it. Don’t even touch it. Put it away, don’t even look at it. Now you have $50 left. Now the smart people, the billionaires of the world, they’ll take half of that $50, put all that away. This right here [the $25], have fun.”

“You want to buy houses, you want to buy cars, you want to buy planes, you want to travel, this right here [the $25] is what you have fun with.”

Shaq’s example is likely tailored for athletes or celebrities who face a higher risk of overspending — a point underscored by his focus on “young guys coming into a lot of money.”

Shaq’s saving plan is similar to a common personal finance strategy called the 50/30/20.

The 50/30/20 is when people put aside 50 percent of income for essentials, 30 percent for discretionary spending, and 20 percent for savings or debt repayment.

Shaq, during his earlier days playing for the Orlando Magic, said he was at risk of being in debt because of not properly managing his finances.

In another interview with CNBC, Shaq said that he did not understand what FICO taxes were after spending his first million-dollar trading card contract on cars and jewelry in a single day.

Triggered by his spending, the president of his bank, apparently someone who wanted Shaq to succeed, gave him a financial wake-up call.

By explaining that while he was given $1 million as a gross product, it does not necessarily reflect his net gain after taxes, meaning the items he purchased will set him back.

In 1996, a much more financially savvy Shaq got traded to the Los Angeles Lakers and received more money management advice from fellow legend Magic Johnson, who advised him to own franchises like Magic was doing.

The four-time NBA champion considers himself fortunate enough as he states that 65 percent of NBA players go broke after they are done playing in the league after five years.

Many of these challenges come from players who don’t know how to manage their new wealth during their teens and 20s and have to be fiscally responsible in their late 30s and 40s as retired professionals.