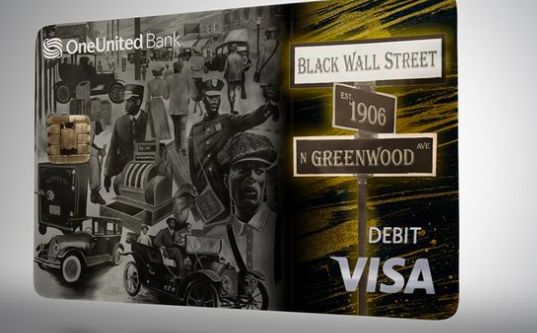

America’s largest Black-owned bank is taking the #BankBlack and #BuyBlack movements to new levels. OneUnited Bank debuted the Greenwood Visa Debit Card on Oct. 27.

OneUnited Bank is Pioneer of Bank Black Movement

OneUnited was founded more than 50 years ago with offices in Los Angeles, Boston, and Miami. OneUnited grew to become the largest Black-owned bank and the bank currently “has almost $700 million in assets,” OneUnited owner and CEO Kevin Cohee told Finurah.

OneUnited Bank began in 1968 with the opening of Unity Bank & Trust in Boston, MA. OneUnited Bank was established by combining Black-owned banks across the country — Founders National Bank of Commerce and Family Savings Bank, both in Los Angeles, Peoples National Bank of Commerce in Miami and Boston Bank of Commerce.

Summer of 2020 Boosts Bank Black Movement and OneUnited

The summer of 2020 took the bank’s success to another level. After the murder of George Floyd in 2020, there was a racial reckoning that put a long overdue focus on a combination of social and economic justice for African-Americans. The unrest prompted the Bank Black movement to be resurrected last summer, and this benefited OneUnited.

“In 2020, the bank doubled its customer base to 100,000 customers. The meteoric growth of OneUnited Bank is directly tied to the immense interest in, and support for the Bank Black movement, which began in 2016 and then went to the next level in 2020 in the wake of the racial justice protests over the senseless murders of George Floyd, Breonna Taylor and Ahmaud Arbery. OneUnited Bank has always been at the forefront of the fight for social and economic justice. We are ‘unapologetically Black,’” said Cohee.

OneUnited, a Community Development Financial Institution, spells out on its website how its practices make a difference to minority consumers:

- 91% of OneUnited Bank’s loans were in census tracts where 70% or more of the residents are minority, compared to only 31% for other lenders in the market.

- The denial rates of African-American and Hispanic applicants compared to White applicants are lower for OneUnited Bank compared to other lenders in the market.

- OneUnited Bank has no loans with high interest rate spreads (higher rates charged to applicants with presumed higher credit risk), compared to 1% of all applicants, 4% of African-American applicants and 2% of Hispanic applicants for other lenders in the market.

OneUnited Offers Financial Literacy to African-American Customers

OneUnited Bank is devoted to helping African-Americans become financially independent through financial literacy iniatives.

“OneUnited Bank’s mission is to make financial literacy a core value in the Black community. The bank offers a fantastic, comprehensive Financial Education Center free to the public in a series of easy-to-understand playlists on a wide number of financial topics,” Cohee told Finurah.

OneUnited’s cornerstone program is the annual OneTransaction Financial Conference that draws speakers to help educate their customers about closing the Black-white wealth gap.

Greenwood Card Honors Black Wall Street Legacy

The Greenwood Card is part of the New Black Wall Street and honors the legacy of the original Black Wall Street in Tulsa, Oklahoma. The historic Black Wall Street was a vibrant community of Black-owned businesses in 1906. In 1921, White rioters killed dozens of African-Americans, and the community and its thriving businesses were destroyed.

The Greenwood Card was created to celebrate the New Black Wall Street and the power of the Black dollar.

Added Cohee, “The Greenwood Card reminds us that our history is important, and the work of our forefathers is manifesting in each of us today.”

Greenwood Card: Tapping Into Black Buying Power

In 2020, Black buying power soared to $1.57 trillion, according to Nielsen. The Greenwood Card wants to tap into it and support Black-owned businesses.

The Greenwood Card is connected to OneUnited’s banking app so users can easily access their funds online. Since the debit card is connected to a checking account, customers can open a Black Wall Street checking account with the bank with no monthly fee.