By Vince Golle

U.S. inflation probably hit the fastest in four decades, helping explain a shift in the Federal Reserve’s approach to monetary policy as well as more consumer anxiety about the economy.

The widely followed consumer price index on Wednesday is forecast to rise 7.0% for the year through December and climb 0.4% from a month earlier. The following day, another Labor Department report is projected to show prices paid to producers surged nearly 10% in 2021. Reports on December retail sales and industrial production arrive Friday.

The inflation surge underscores why U.S. officials are preparing for a quicker normalization of monetary policy than previously anticipated. Adding to the case is evidence of a tight labor market, including a jump in wages and falling unemployment in data on Friday.

Fed watchers may get more clarity in the coming week on whether the interest-rate liftoff may come as soon as March, and when the central bank will begin shrinking its $8.8 trillion balance sheet.

Chair Jerome Powell testifies Tuesday before the Senate Banking Committee on his nomination to a second four-year term. Two days later, Fed Governor Lael Brainard appears before the same panel at a confirmation hearing on her elevation to vice chair. Other Fed officials set to speak include Loretta Mester, Esther George, Charles Evans and James Bullard.

What Bloomberg Economics Says: “With the unemployment rate dropping below the median FOMC participant’s estimate of the long-run neutral rate and wages growing briskly, this jobs report likely will alleviate any lingering doubts on the part of more-dovish FOMC members.”–Anna Wong and Andrew Husby. For the full report, click here

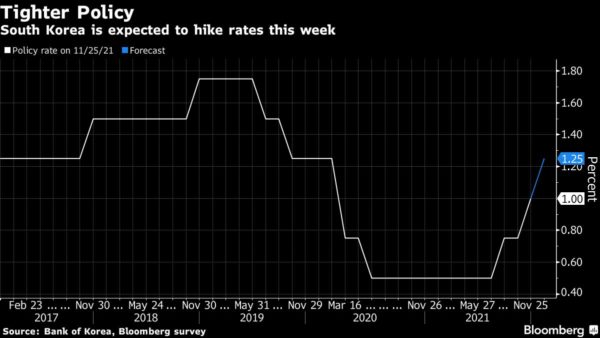

Elsewhere, inflation data may show weakening Chinese price pressures, Germany will give an indication of its growth in the last quarter of 2021, and both South Korea and Romania are likely to keep tightening monetary policy.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

Asia

Sri Lanka hosts a visit by Chinese Foreign Minister Wang Yi this weekend as the country mulls whether it might need to ask the International Monetary Fund or Beijing for help as its currency reserves run low.

South Korean jobs figures come ahead of a Bank of Korea interest rate decision on Friday, with some economists now predicting a back-to-back hike by Governor Lee Ju-Yeol.

China releases price data midweek that could offer more evidence that inflationary pressure has peaked there for now. By contrast, Indian inflation is expected to pick up again.

China’s trade figures at the end of the week are set to show a new annual export record as Beijing sticks to a Covid-zero strategy that keeps its factories open, taking advantage of recovering global demand. The Bank of Japan gives its assessment of the health of the country’s local economies ahead of a policy meeting the following week.

Europe, Middle East, Africa

Joachim Nagel’s first full week as Germany’s Bundesbank president will be marked by a virtual handover event on Tuesday featuring his predecessor, Jens Weidmann, Finance Minister Christian Lindner, and European Central Bank President Christine Lagarde.

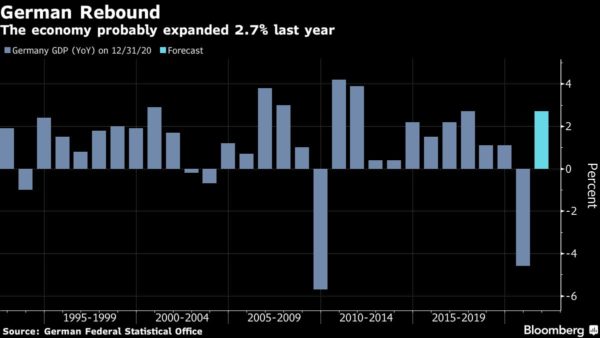

Meanwhile, on Friday, an official German estimate of 2021 full-year growth will offer the first indication in the Group of Seven of expansion for the fourth quarter, following news that industrial production there unexpectedly shrank in November. How that drop impacted overall euro zone factory output will be seen in data on Wednesday.

Friday will also be a highlight in the U.K., where monthly gross domestic product and industrial data for November will be released, probably showing a fourth consecutive increase.

Euro region inflation remains a hot topic after a surprise acceleration reported on Friday. ECB Executive Board member Isabel Schnabel said Saturday that the continent’s green energy transition may mean “inflation remaining higher for longer.”

Eastern Europe will be a hot spot for monetary policy action. Romania’s central bank is likely to raise interest rates on Monday, while decisions are also due on Thursday in Serbia and Hungary.

Figures from Ghana due on Wednesday are expected to show inflation accelerated to 12.5% in December, exceeding the top of the central bank’s 6% to 10% target range for a fourth month. Even so, officials may hold off on raising rates as they wait to see whether November’s 100-basis point increase arrests inflation.

Turkey’s current-account balance data on Tuesday is likely to show a swing to deficit in November in the absence of a significant boost from tourism. Turkey posted a surplus for three months before November thanks to a jump in trade and balance of services.

Latin America

Mexican industrial production figures for November, out Tuesday, may add to evidence that Latin America’s No. 2 economy is falling into a recession.

The December reading on Brazil’s consumer prices is widely expected to show inflation has peaked, and ended 2021 slightly below the central bank’s 10.2% central forecast. Getting it back to target won’t happen until the third quarter of 2023 at the earliest, the bank now projects.

Mexico’s labor market has been on an upswing, although it remains below pre-pandemic levels. Ongoing weakness in services employment will likely weigh on December formal jobs data reported Wednesday. In Brazil, the services sector has also been struggling and November data due on Thursday will likely show activity slowed for a sixth month.

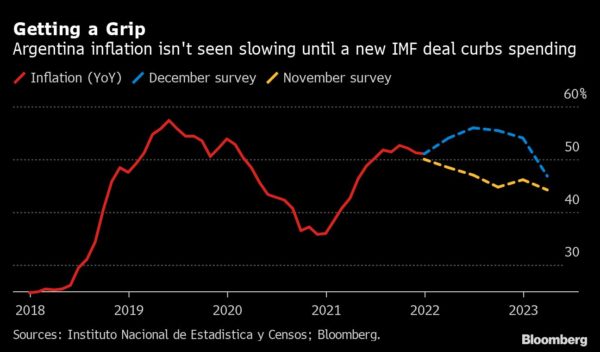

Look for Argentina’s consumer price report for December on Thursday to show a marginal easing from November’s 51.2% pace. The trajectory for 2022 inflation will owe much to the timing of a new loan accord with the IMF that sets targets on government spending and debt.

Inflation, rising interest rates and high household debt have soured the sentiment of Brazilian consumers. Sidelined shoppers have many analysts looking for a fourth month of negative prints in the retail sales data posted recently.

More stories like this are available on bloomberg.com.