New York state and the U.S. Consumer Financial Protection Bureau are accusing MoneyGram International Inc. of harming customers by delaying international money transfers, failing to disclose prices as well as not informing users when the funds would arrive.

Dallas-based MoneyGram is one of the world’s largest money transfers services. As of April 7, 2022, the company has a worth of $1.02 billion, according to Macro Trends. In February 2022, MoneyGram was acquired for $1 billion in cash by private equity firm Madison Dearborn Partners.

The lawsuit, filed April 20 in Manhattan federal court, claims that MoneyGram has failed to deliver funds or issue refunds in a timely manner. New York and the CFPB said U.S. remittances abroad total more than $100 billion annually.

The lawsuit is seeking unspecified fines and damages. New York and CFPB also want an order blocking MoneyGram from future law violations.

After the news broke of the lawsuit, shares of MoneyGram dropped as much as 8.4 percent in New York, Bloomberg reported.

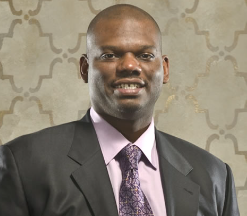

“Our immigrant communities trusted MoneyGram to send their hard-earned money back home to loved ones, but MoneyGram let them down,” New York attorney general Letitia James said in a statement. “Consumers deserve to know where their money went. Companies have an obligation to be transparent with consumers, treat them fairly, and follow the law, but MoneyGram repeatedly failed to do so.”

MoneyGram, with 430,000 locations worldwide, is a non-bank financial services company through which consumers can send money, known as remittances, from the U.S. to more than 200 countries and territories. A significant portion of the company’s money-transfer transactions are initiated by immigrants or refugees in the U.S., sending money back to their native countries. Hundreds of thousands of New Yorkers use MoneyGram every year for millions of transactions. In 2020, more than 600,000 individuals sent and received money at MoneyGram locations in New York more than 3.8 million times.

According to CFPB, MoneyGram has been engaged in deceptive practices for a number of years.

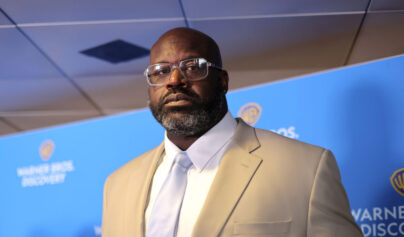

“MoneyGram spent years failing its customers and failing to follow the law, ignoring customer complaints and government warnings in the process,” said CFPB director Rohit Chopra. “MoneyGram’s long pattern of misconduct must be halted.”

MoneyGram responded to the lawsuit with a statement, saying it is “deeply disappointed” by the suit.

“The Bureau and NYAG know that MoneyGram has invested heavily in compliance to build a best-in-class compliance program with record-low anti-fraud numbers designed to protect consumers against harm,” the company said in a statement. “We have spent considerable time attempting to educate the CFPB about the Company’s robust and effective compliance efforts and the weakness of its case, including the complete absence of any consumer harm.”

The company has been in hot water before with the government. In 2009, the company agreed to pay $18 million to settle fraud charges brought by the Federal Trade Commission, and was required to implement a comprehensive anti-fraud and agent-monitoring program. In 2012, it agreed to forfeit $100 million in a deferred prosecution agreement with the U.S. Department of Justice, admitting it criminally aided and abetted wire fraud and failed to maintain an effective anti-money laundering program. In 2016, MoneyGram agreed to pay $13 million to 48 states, including New York and the District of Columbia, to compensate defrauded consumers. In 2018, it agreed to pay $125 million again to the FTC to settle allegations that it failed to take steps required under the agency’s 2009 order. And, in March of 2022, it agreed to pay $8.25 million for failing to adequately monitor agents engaging in suspicious transactions to China.