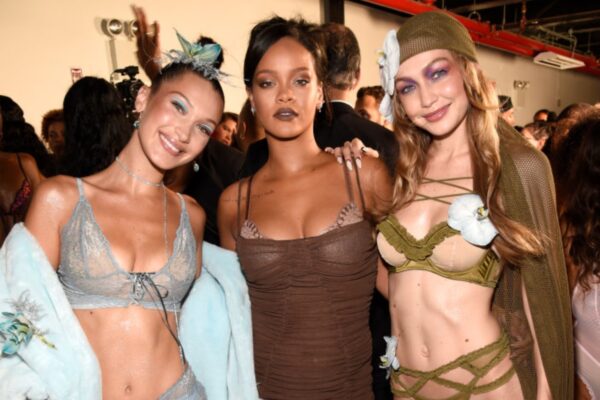

Over the years, bad gal singer Rihanna has elevated herself from an award-winning recording artist to a formidable entrepreneur. Her inclusive lingerie brand, Savage X Fenty, which launched in 2018, quickly gained traction as an intimate apparel brand of choice among a diverse group of consumers. It has given lingerie powerhouse Victoria’s Secret a major run for its money.

Savage X Fenty‘s launch came on the heels of the debut of Fenty Beauty, which launched in 2017, and has since grown to a $550 million business. Rihanna, who reached billionaire status in 2021, owns 50 percent of Fenty Beauty. She holds an estimated 30 percent stake in the Savage X Fenty lingerie brand.

The brand has redefined beauty standards by promoting inclusivity in fashion. Positioning itself as a body image positivity brand gained it popularity from investors, which has led to Savage X Fenty capturing a sizeable market share in the global lingerie industry.

All signs point to Rihanna eventually being a frontrunner for intimate apparel and loungewear as it ventures into its most high-stakes business venture: becoming a public company.

It has been reported that the billionaire’s online company is considering a $3 billion initial public offering. According to people familiar with the matter, Savage X Fenty is working with banks including Goldman Sachs Group Inc. and Morgan Stanley. While the timing of a final decision of an IPO is subject to change, a listing can happen as soon as this year.

In a world that’s been dominated by tech and a plethora of software companies going public, an IPO would make the beloved brand the first apparel company to list this year. Becoming the newest ticker on the stock market could be a strategic move to raise capital and propel further growth.

Being on the public stage have its advantages, but it can also come with a few challenges.

Going public opens the door for a company to raise funds by issuing shares of its company to the general public. By being a private company, it can be difficult to secure capital in large amounts, unless money is borrowed to finance operations, overhead costs or prototype a new product. An IPO creates liquidity for the company’s shares and provides cheaper access to capital.

IPO announcements also generate publicity.

Not that Savage X Fenty needs an introduction, but for smaller companies, being listed can be a big deal for gaining notoriety with prospective investors and can generate media coverage, which can help brand recognition. Inherent values lie within the visibility of a brand and having the right investors can help drive the price of the stock.

There are several reasons why a company chooses to go public, among them mergers and acquisitions.

Acquisitions can be a motive for an IPO. The appetite to acquire a competitor that can potentially increase the success and valuation of your company is an overarching incentive for many CEOs who are eying a public listing. One study found that during the first five years of a company going public, firms spend more money on acquisitions than they do on other expenses.

Costs for getting your company listed aren’t cheap. The process usually entails substantial costs, including underwriting, legal, accounting fees and more. It’s also important to note that those fees are just one and done. Companies listing on NASDAQ or the New York Stock Exchange will have ongoing expenses every year. In the last three years, companies have sought a cheaper route to go public; through a special purpose acquisition company or SPAC.

When taking the IPO route, founders take the risk of being stripped of power.

The dilemma every founder should have at the forefront of their mind is the risk of being ousted if they choose to seek an IPO. Every public company is required to elect a board of directors that represents shareholders’ interests. They’re the frontrunners on setting policies for the executive management and assessing whether the company is performing well. The greatest power that they wield is stripping founders of their power, or evening firing them.

There will also be increased regulatory oversight attached with going public.

Unlike private companies, public firms are subject to abiding by Security and Exchange Commission rules. Being listed on a public stock exchange places a company under the supervision of the SEC or state regulatory agencies that keep a watchful eye on public corporations for the interest of investors. More regulatory rules can affect the way how a company chooses to run its business if it’s not compliant with SEC rules and regulations.