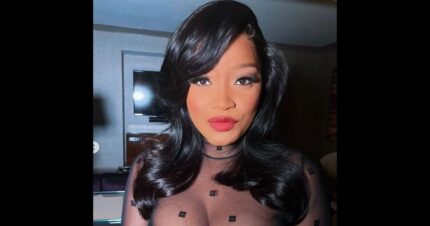

Even with an 808 credit score, Roshawnna Novellus still found it challenging to refinance her home. It wasn’t until she went to a non-white mortgage broker she was able to get approved.

Essentially, Novellus’ financial profile was considered near perfect. Besides a great credit score, she had a low debt-to-income ratio and large cash reserves, and yet she was denied three times.

“This current battle felt particularly insulting given how much time I spent making sure my finances exceeded the basic requirements for a home loan,” Novellus wrote in her first-person Business Insider article.

The first time she was denied during her refinance process was because the lender took issue with Novellus taking out a Paycheck Protection Program loan for her business. Although the loan was forgiven, the lender expressed that it was a poor business decision and denied her, Novellus explained.

The second lender denied her because they weren’t comfortable with her having additional streams of income. Because the amounts she made each month from speaking engagements, acting, and fellowships wasn’t a consistent amount, she was considered too high risk.

“I ended up consulting with a retired underwriter who happened to be Black,” Novellus wrote. “She told me that she never denied anyone like me during her entire career in the mortgage underwriting industry. She also told me that I either had to decide to let discrimination win or accept that I would have to keep trying to find an institution willing to finance someone who looked like me.”

After being referred to a more diverse lender team, Novellus was approved and set a closing date for three weeks later.

Even before Novellus was a victim of prejudice, she used her company EnrichHer to fight against racial and gender-based disparities. Her fintech platform helps make capital accessible and affordable for businesses run by women and people of color.

But this is hardly new, and Novellus isn’t the first to experience discrimination regarding home ownership.

When Nathan Connolly and his wife, Shani Mott, were looking to appraise their home, it was completely undervalued. At first, the appraisal company estimated their home’s worth at $472,000. When the couple submitted a second profile and removed any indication of race, a second appraiser valued it at $750,000. The Maryland couple has since filed a lawsuit.

And Wells Fargo rejected half of its Black applications for mortgage refinancing earlier this year. Discrimination in the housing market is far from new, as redlining was a widespread practice in the 1930s. Government-sponsored Home Owner’s Loan Corporation and the Federal Home Loan Bank Board would deny lending and investment opportunities to Black people, and according to a report by The New York Times, African-Americans are not so far removed from those practices. When PPP loans were circulating in 2020, 75 percent of the loans went to predominantly white census tracts. And in 2019, Citi, Bank of America, and JP Morgan made 91 percent fewer small SBA 7(a) loans to Black-owned businesses than were given to white-owned businesses, Business Insider reported.

“These unlawful practices have had a devastating impact on society, trapping families in poverty for generations,” Novellus wrote. “Imagine how much economically stronger communities of color would be today had they been able to establish themselves in business and real estate decades ago.”