By David Pan

Bitcoin traded back above the $22,000 price level as concern about a widening crackdown by regulators eases.

The largest cryptocurrency by market value jumped as much as 3.2% to $22,323 during New York trading, after turning negative earlier in the session. It has traded mostly below that level since a string of regulatory actions were unveiled last week. Binance Coin gained about 2%, while Ether increased 4.7%.

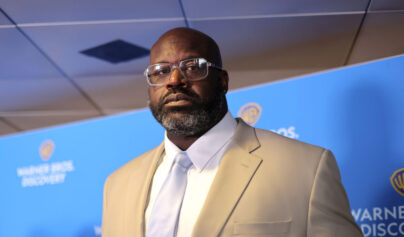

“It is interesting to me that you’re seeing crypto rally when you have the SEC continuing to crack down on a lot of these businesses,” said Shawn Cruz, head trading strategist at TD Ameritrade. “I’m not entirely certain I would expect that to remain.”

Most cryptocurrencies fell Monday, with the native token of the Binance exchange dropping the most since a November market meltdown. The New York State Department of Financial Services directed Paxos Trust Co. to stop issuing new tokens of crypto’s third largest stablecoin, a Binance-branded coin known as BUSD that has roughly $16 billion in circulation. Paxos also noted that the US Securities and Exchange Commission had notified the firm about a potential enforcement action. Kraken reached a settlement with the SEC last week.

Crypto-related stocks also rose, with Coinbase Global Inc. halting a seven day slide, while MicroStrategy Inc. jumped almost 9%.

Bitcoin spent most of last year trading in tandem with stocks, especially tech companies’ shares. They all got hit when the Federal Reserve began a campaign of raising rates and reducing liquidity to arrest the fastest inflation in decades.

The correlation broke off when FTX collapsed and cryptocurrencies plunged, only to return in the new year. The S&P 500 has added about 8% in 2023, while the tech-heavy Nasdaq 100 has advanced 15%. Bitcoin has risen 34% in 2023, after tumbling 64% last year.

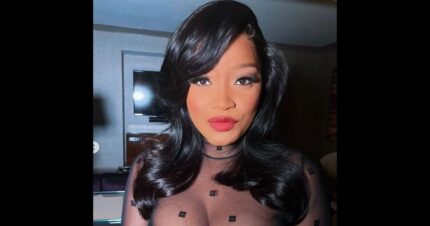

“We have observed that crypto markets tend to do well during US hours, a sign that institutional investors may be behind the buying interests,” said Teong Hng, chief executive at crypto investment firm Satori Research.

–With assistance from Vildana Hajric.

More stories like this are available on bloomberg.com.