By Michael Sasso

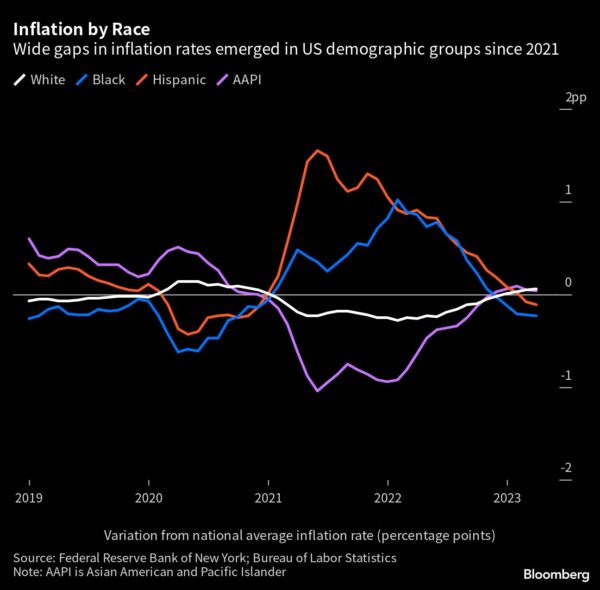

Black and Hispanic households faced higher inflation than the national average in 2021 and 2022, according to a study from the Federal Reserve Bank of New York, but the gaps have now reversed.

When costs of living started to spike in the US two years ago, differences emerged among demographic groups. That was mainly because Black and Hispanic consumers tend to spend a larger share of their budgets on used cars and gas, two items that saw prices soar at the time.

In mid-2021, when the inflation gap was the highest for Hispanic households, used-car prices surged by more than 40%. The increase disproportionately affected essential workers and those who could not work from home.

The researchers used federal consumer surveys to calculate how much various groups spend on different items, such as cereal, rent or cars. When the nationwide inflation rate was tepid, in 2019 and 2020, consumer-prices growth varied modestly among races, the study shows.

This year, as the rate of inflation eased from its 2022 peak, the gaps among racial and ethnic groups have reversed. White and Asian Americans are now seeing slightly more elevated rates than the average.

The report also shows significant inflation gaps by level of income and education — and some those differences have reversed as well over the past year.

Middle-income households, the young, people without a college degree, residents of the South and Midwest, and rural consumers all faced higher inflation than the overall average in 2021.

But this year low-income households are hit the hardest by rising consumer prices, according to the report.

The research was published as part of a series, called Equitable Growth Indicators, that tracks differences in spending and finances among racial, ethnic and income groups.

Read More: US Veterans Earn $7,000 Less, More Likely to be Out of Workforce

More stories like this are available on bloomberg.com.