By Paulina Cachero

On TikTok, Macy Hung is living the New York City dream. At just 21 years old, the California native has a coveted job in beauty marketing and lives in a penthouse apartment overlooking the Brooklyn Bridge. She spends lazy weekends shopping in Soho and throws sumptuous dinner parties with friends.

What you don’t see online is what it takes to make that lifestyle a reality. Hung has four roommates, works 10 hours a day, has side hustles and used $1,500 of the $20,000 she saved up working full-time in college to move into the apartment.

“I knew things were expensive in Manhattan, but it’s my dream to live in the city,” said Hung. “If you’re not making six figures, it’s hard to get by.”

Living in New York has always required sacrifices and tradeoffs for those just starting out, especially for those with visions of keeping up with — or at least emulating — the Joneses. But as rental prices grow at nearly twice the rate of entry-level salaries, it’s squeezing the incomes of the current crop of college grads, many of whom were raised on social media and refuse to compromise on lavish nights out and living in the heart of the Big Apple.

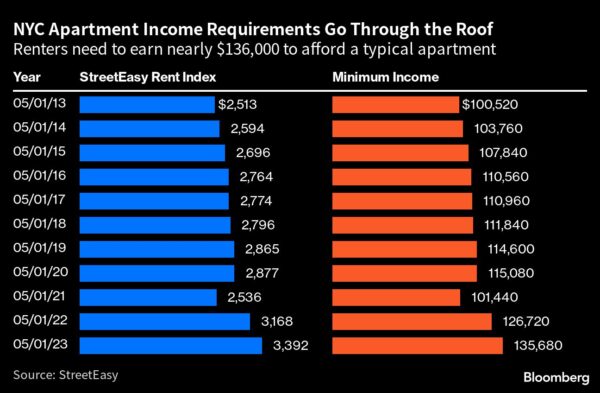

Renters today need to earn more than $135,000 to afford a typical apartment in New York on their own, according to StreetEasy. That’s the highest in data going back 16 years, according to the analysis, which follows the rule of thumb that individuals should spend no more than 30% of their income on housing.

Recent graduates who can’t bolster their entry-level earnings with the “bank of mom and dad” are embracing a “whatever it takes” attitude. Sometimes that means taking on several roommates to live in a prime location, or finding side gigs to cover those expensive Instagram- and TikTok-worthy moments.

That lag between wage growth and cost of living is exacerbating the disparity between young people who can rely on family wealth and those who have to make more sacrifices to afford living in the land of opportunity, said Lisette Nieves, president of the Fund for the City of New York.

“We’re in a once-in-a-generation housing crisis,” said Nieves, whose institution is charged with implementing policy to advance the functioning of social services and nonprofits.

The city’s rental market is one of low inventory and high demand. It’s picked up since its pandemic lows, with Manhattan apartments flying off the market in May after an average of 35 days, the fastest rate in nearly a year, while the median rent on newly signed leases reached $4,395, according to Douglas Elliman. That’s the third straight month rent prices hit a record high. Rents in Brooklyn hit $3,550, a second consecutive monthly record, while units in northwestern Queens, including Astoria and Long Island City, hit $3,402.

All told, rents grew 20% over the 12-month period ending in December, reaching a median of $3,392 in May, according to StreetEasy’s economist Kenny Lee. That’s nearly twice the rate of the 11% growth seen in entry-level earnings in the same time period, according to data from Glassdoor.

Hung dealt with that head on, when she and two friends began hunting for a three-bedroom apartment after graduating from Cornell University last spring. Struggling to find something in their budget, the trio realized they might have more luck searching for a home for five. Nearly a month and a half and 100 apartment listings later, the girls landed a five-bedroom apartment — what they call a “Manhattan sorority house” — in November.

The housing hunt was just half the battle. With a monthly net rent of $11,333, they scrambled to prove they had a combined income of nearly half a million dollars — most landlords require that renters earn 40 times the monthly rent. A fortunate few can turn to guarantors, who are typically family members who earn 80 times the monthly rent.

For many, like Jordan McKinney, living in Manhattan is entirely out of the equation. The 22-year-old stylist assistant treks to photoshoots across Manhattan from Flatbush, Brooklyn, where he pays $935 for a room. While he’s not living quite the lifestyle he imagined, it’s the only way he could give himself a shot in an industry with “nepo babies” who don’t have to worry about only earning $20 an hour.

“If I paid $1,500 to live closer, that does not include food, transportation, or going out for a nice mai tai,” said McKinney, who works odd jobs in between gigs to make ends meet. “I need $2,000 a month just to survive.”

For Piper Phillips, 22, her priorities were living in a prime location and maintaining an active social life. Sometimes that means forking over exorbitant amounts for “Ritz Wednesday” cocktails topping $20 at Nubeluz rooftop bar and $90 dinners at Scarpetta with her friends who have high-paying banking jobs.

While the sticker price of those experiences makes her cringe, the marketing director’s two side gigs make her feel “less guilty” — and ensure she’s not living beyond her means. Once Phillips is off the clock for her day job, she posts TikToks on her personal account, where she commands $1,000 for sponsored posts, or creates content for other companies. Her side gigs put her on track to bring in a total of roughly $100,000 this year, she said.

It’s also how she affords living in a $6,000 one-bedroom apartment in Hell’s Kitchen. That is, with the help of two roommates and a flex wall.

“I worked so hard to get here, I didn’t want to compromise on the life I wanted to live,” said Phillips, whose TikTok gives young people advice on how to network in New York. “The cost of living here is an investment in myself. It sounds crazy to justify $25 cocktails, but being here opens doors for my career. That’s worth the costs.”

Read More: Young Professionals Are Leaving New York

More stories like this are available on bloomberg.com.