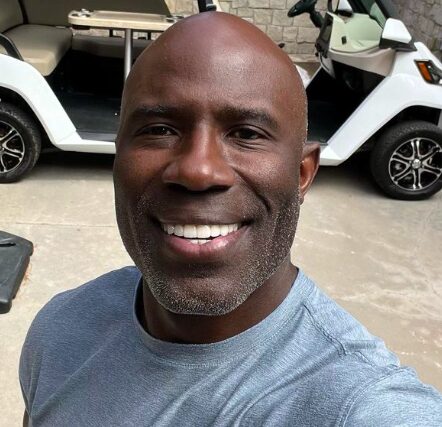

When Terrell Davis entered the NFL, financial literacy wasn’t part of the onboarding process.

His first NFL contract with the Denver Broncos was a modest three-year deal after being selected in the sixth round of the 1995 draft.

Lessons Learned

It included a $38,000 signing bonus and a rookie salary of $119,000, according to Spotrac. Despite these humble beginnings, Davis quickly became a standout player, which led to the Broncos renegotiating his contract after his stellar rookie season, ultimately signing him to a five-year, $6.8 million deal with a $1 million signing bonus in 1996.

Like many players, he had to navigate finances on his own, and initially, he made a common mistake — trusting an adviser referred to him through another contact and not vetting the money contact on his own.

After figuring out that some of the decisions being made on his behalf benefitted the adviser and not his portfolio, he restructured his team and is now in more control.

“I did what everybody else did, right? I found a financial adviser, and I thought things were good,” Davis recalled in an exclusive interview with AfroTech.

“He wasn’t a bad advisor, he didn’t do anything illegal, but he was unethical,” the retired baller explained. “What I mean by that, he’ll have accounts that he would duplicate. They’ll hold the same stocks and bonds basically. But he would get commissioned based off the amount of accounts that he had open. So, he would just spread you thin and you’d have the same accounts. He was making money, he was making a lot of money.”

According to Davis, when he discovered that the amount of statements were too much for the amount of money that he had, he became curious.

Realizing the need for a more transparent and ethical approach, Davis turned to a trusted friend for advice, leading him to hire a team of advisors who now function as his unofficial board of directors.

“Go get successful people who have no stake in what you have. They’re just there to help you,” his friend advised, a strategy that has served Davis well in managing his investments.

This team helped Davis diversify his assets, particularly when real estate, one of his main investments post-retirement, crashed in 2008. However, even with a group of five individuals that form an unofficial board of directors helping him he still had some major hiccups with his finances, allowing his passion for one form of gaining equity to override the strategies to protect his wealth that they suggested.

“Everything I had was in real estate,” Davis said, acknowledging that the lack of balance in his portfolio was a lesson learned. “I had a year in 2007, I think 2008, when the economy shifted and real estate just kind of went into the tank. I was really deep into real estate.”

Davis said he was so focused on what he wanted to do in real estate, that when his advisers pointed out that he needed to diversify, he didn’t listen.

“I was like, ‘I’m just gonna blow past this red flag.’ I liked the feel of it,” he said, confessing, “That was a part where things didn’t go well and I had a lot of bad deals.”

Janathan Barrett from the Sports Business Journal notes that “prioritizing trust over experience,” is the No. 1 mistake that professional athletes make when they first sign their contract to play on the big stage. With more money than they have ever seen, they tend to hire people based on relationships and not skill sets.

In Davis’ case, he trusted that the financial adviser was going to be honest, because a friend recommended him.

“Trust is important, but so is knowledge and experience,” Barrett stated.

Another mistake that professional athletes make when they first enter their respective sports, is not setting a clear goal for their finances and sticking to a strategy to achieve it.

“Before recommending any specific financial strategy or investment options for professional athletes, I want to make sure that we understand very clearly what their long-term goals are,” Chad Willardson, president of Pacific Capital and a person who helps mentor ultra-high-net worth money makers and athletes, explained, “Their long-term goals determine the investment strategy and the investment options that are presented to them.”

While chasing money in the real estate market, Davis ignored the financial strategy his team suggested, not keeping the collective vision for long-term success.

In 2024, with an estimated net worth of $14 million, it seems that Davis is a lot more stable. He, now, emphasizes the importance of diversification, with investments in real estate, stocks, and business ventures.

He has become a businessman, becoming the co-owner of Defy, a performance sports drink, and serves as an ownership partner at Alpha 1 Tax & Wealth.

The financial hurdles he overcame in the beginning of his career, have kept him cautious to consider the advice of sound advisers, even over his impulses and instincts.