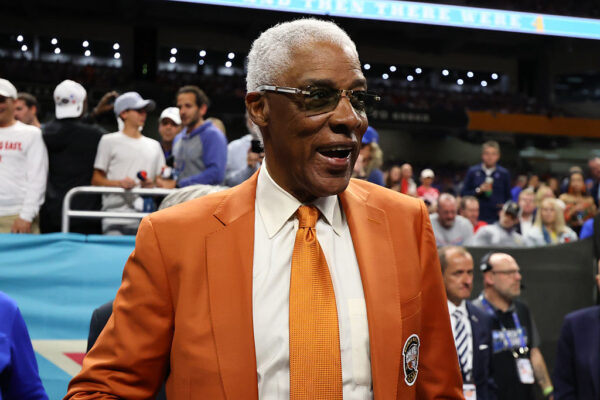

Julius Erving redefined professional basketball with his spectacular aerial displays and revolutionary dunking ability, but his most impressive performance may have taken place in the business world. The legendary athlete, known globally as “Dr. J,” built a remarkable corporate portfolio centered around a groundbreaking $100 million investment in a Coca-Cola bottling franchise, creating the first Black-owned bottling operation in the company’s worldwide system.

Dealmaking

Well before athlete business ventures became standard practice, Erving was strategically building his financial future. The Philadelphia 76ers star recognized that his playing days would eventually end, and he needed to establish lasting wealth through smart investments and calculated business moves.

During his 14th season as a professional player in 1985, Erving made the deal that would cement his business reputation, according to the Basketball Network. Working alongside partner J. Bruce Llewellyn, he along with a group of other investors acquired majority control of the Philadelphia Coca-Cola Bottling Company.

Coca-Cola U.S.A., which owned a stake in that bottling operation, sold off a large portion of its shares to Llewellyn’s group (which included Erving). fter the acquisition, Erving was not only an investor / co-owner but also had marketing/spokesman roles in support of the Philadelphia bottler.

New York lawyer Llewellyn was a trailblazing businessman. He acquired Fedco Food Stores, a supermarket chain in the Bronx, in 1969 and turned it into a major success before selling it. And, he co-founded 100 Black Men of America in 1963. Although he secured the Coca-Cola deal, there seem to be no reports of how much Erving invested in the landmark deal.

“Dr. J was one of the guys that I idolized from the business side of things. I wanted to take that same passage and show that I was more than just a basketball player,” Michael Jordan later explained, crediting Erving as his entrepreneurial inspiration.

The bottling company proved to be an exceptional investment, valued at $100 million at the time of purchase and ranking as the fourth-largest Black-owned business in America. Erving held his majority stake for 20 years, creating a dependable income stream that would support his financial portfolio long after hanging up his sneakers in 1987.

The Coca-Cola deal became the foundation for Erving’s broader business strategy. Five years later, he launched The Erving Group, a consulting company that provides strategic guidance to startups and established businesses across various industries. This venture established Erving as a serious business professional rather than simply a retired athlete lending his name to projects.

His investment philosophy extended into entertainment and technology through co-founding Q&A / Venice Music, which combined his passion for music with emerging tech opportunities. He also recognized potential in sports-related businesses, investing in the National Thoroughbred League and exploring opportunities beyond basketball.

One of Erving’s shrewdest early moves came in 1983 when Electronic Arts offered him and Larry Bird a choice for their video game partnership: accept $25,000 upfront or take 20,000 stock options. Bird chose the immediate cash, but Erving opted for the equity stake. When EA went public in 1989, those shares became worth millions, showcasing his ability to think long-term and embrace emerging opportunities.

This forward-thinking approach continued as Erving adapted to new markets, including an investment in MobileCoin, a cryptocurrency company, proving his willingness to explore innovative financial technologies. His real estate investments span commercial and residential properties in top markets across the country, adding diversification and steady returns to his portfolio.

In 2016, Erving made another smart strategic move by selling the lifetime rights to his “Dr. J” brand to Authentic Brands Group, the same company that manages celebrity rights for icons like Elvis Presley and Muhammad Ali. This deal provided both immediate payment and ongoing annual royalties, ensuring his brand continues generating revenue.

Today, Erving’s net worth is estimated at around $50 million, according to Celebrity Net Worth, built through decades of thoughtful investments and strategic business decisions. His success has earned respect across both sports and business communities, with other athletes studying his approach to building wealth and managing their personal brands.