By Suzanne Woolley

The stock market had a banner year in 2020, but a large portion of Black Americans missed out on the gains.

Only 55 percent of Black Americans said they owned stocks in 2020, compared with 71% of white Americans, according to the latest Ariel-Schwab Black Investor survey released Thursday. That’s the lowest number found in more than 20 years of the survey, though the survey hasn’t been conducted every year.

“The discouraging news is that Black investors lag behind white investors when it comes to saving and investing because of historical reasons, social and cultural reasons,” said Carrie Schwab-Pomerantz, president of the Charles Schwab Foundation. “It means that we as a country and as an industry have a lot of work to do.”

Over the long run, investing in stocks has been a powerful way to build wealth. The bull market in stocks in the 1990s increased white wealth by about $400,000 per household within a decade, while average black wealth rose by less than $10,000, a recent economic paper showed.

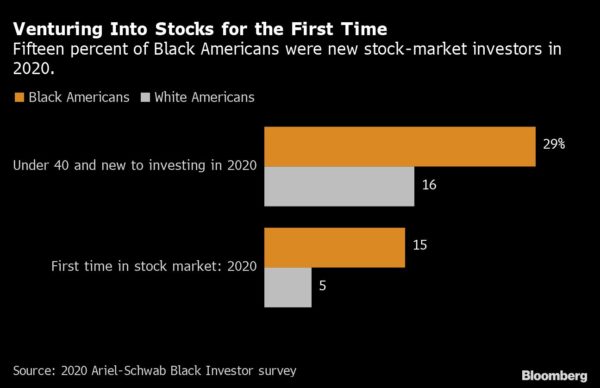

There were some notes of change in the data: Younger Black people are getting more involved in the stock market. Of those under age 40, 29 percent said they were stock market newbies in 2020, compared with 16 percent for young white people.

Across age groups, three times as many Black people as white people said they’d invested in the stock market for the first time last year, when the S&P 500 Index gained more than 16% and the Nasdaq Composite Index jumped more than 43 percent.

That has led to more conversations in Black families about the stock market. Only 18 percent of Black people under age 40 said their families talked about stocks when they were growing up, but 41 percent said their families currently talk about stocks.

Workplace retirement savings programs like 401(k)s are the way that close to two-thirds of Black people first get involved in the stock market. Participation in retirement plans is about the same for white and Black people, near 55 percent.

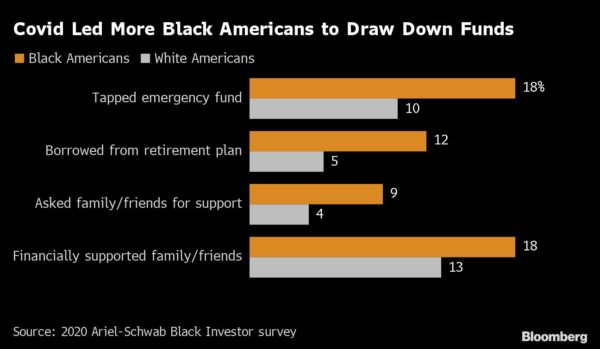

More than twice as many Black investors as white — 12 percent compared with 5 percent — said the pandemic had led them to borrow from their 401(k) plan, and they were three times as likely to say they delayed or deferred student loan payments.

“Because the wealth gap is so large, and getting larger, when you go through tough economic times, African-Americans are more likely to take hardship withdrawals from a 401(k), a loan from a plan, or to help out a family member financially,” said John Rogers, co-CEO and chief investment officer at Ariel Investments. “The pandemic has just compounded the wealth challenges that we face in this country.”

The racial wealth gap is enormous. The median household wealth of a white household was $184,390 in 2019, and only $20,730 for the median black household, according to the 2019 Survey of Consumer Finances. A report from The Brookings Institution, “Examining the Black-white wealth gap,” noted that during the economic downturn between 2007 and 2013, median net worth for Black families fell 44.3 percent, compared with a 26.1 percent decline for white families.

The Ariel-Schwab online survey of more than 2,100 Americans age 18 and older, with 2019 household income of $50,000 or more, was conducted in December.

For more articles like this, please visit us at bloomberg.com.