Often, we are taught to save our money and use a financial adviser to assist us in wealth building. But have we ever considered how our relationship with money will allow us to generate wealth for our families? The National Endowment for Financial Education (NEFE) has developed a framework known as a personal finance ecosystem that defines our individual financial well-being.

Founded in 1972, NEFE produces free financial educational tools to help people make more empowered money decisions. It also publishes various financial guides such as “40 Money Management Tips Every College Student Should Know” and “Your Spending, Your Savings, Your Future.” According to NEFE, many of their activities are targeted to those who face financial challenges that are not being addressed by others. Among their target audiences are youth, low-income individuals and families, and people in difficult or unusual life circumstances.

“The best way to provide financial education is to provide insight when someone needs to make a financial decision,” Calvin Williams, founder and CEO of Freeman Capital, told Finurah. “There needs to be assistance and accountability so that you can support someone.”

How to Build Your Personal Finance Ecosystem

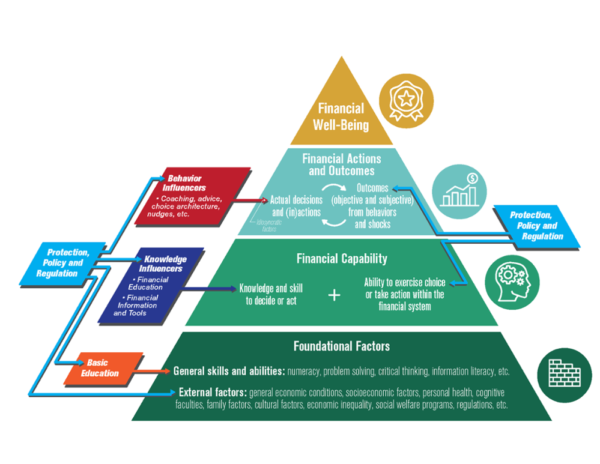

The personal finance ecosystem is based on a pyramid. At the bottom of the pyramid is “Fundamental Factors,” which includes your basic financial knowledge and skills. You can move up the pyramid by adding more education and financial tools. The next rung on the pyramid is “Financial Capability.” This is when you turn your education into action by making financially capable decisions. The next tier on the pyramid is “Financial Actions and Outcomes.” This tier can be reached by seeking professional financial help, such as financial coaching. The top-level is “Financial Well-Being,” where all of your tools, education, and actions result in your financial stability.

The Purpose of a Personal Finance Ecosystem

The purpose is to rise to financial well-being. The pyramid can be used for each of your financial goals as well as your overall financial state. Say your goal is to raise your credit score, you first must realize which financial decisions will impact your credit score. You also have to be aware of outside factors, such as new federal guidelines, that could affect your goal. Then you must gain knowledge on how to raise your credit score and put that knowledge into action.

Our financial decisions impact our everyday lives. Having a personal finance ecosystem can help you make better money decisions. A personal finance ecosystem identifies the foundational factors informing our decision-making abilities. For instance, what knowledge or skills do people possess to take action in a way that will enhance, not hinder, their wealth? And, what are the financial outcomes of the decisions we decide to make? These three distinct concepts define our personal financial well-being and ability to build wealth.

We all possess a personal finance ecosystem and it defines our financial well-being. However, our financial wellbeing can change if we take the appropriate steps to shift at every level of the pyramid, but that would have to happen with financial education/literacy.

Why Understanding Our Personal Finance Ecosystem Is Important to the African-American Community

A recent study released by TIAA Institute revealed that African-Americans knowledge of personal finance lagged behind their white peers.

“We realize that especially in underrepresented communities, the personal finance ecosystem does not always benefit people and increase their net worth,” says Williams. “As financial advisors, it is important to know where people are coming from and how to piece together an ecosystem that builds confidence, tools, and access so that they can build wealth.”

TIAA Institute’s report revealed some findings that support Williams’ ideas as well. The report found that 66 percent of African-Americans polled believed they were financially comfortable — 12 percent less than their white counterparts. In addition, 42 percent of African-Americans working full-time supplemented their income with a second job — 14 percent more than whites. Finally, 45 percent of African-Americans believe they carry too much debt — 10 percent more than whites.

Financial education plays an important role in helping people achieve their financial goals. This idea highlights the importance of understanding a personal finance ecosystem. After all, everyone possesses a level of financial well-being that is based on their behaviors and influences. However, for many Americans, their personal finance ecosystem does not have a foundation built on wealth management. Instead, it is influenced heavily by friends and family, driving consumerism, adds Williams.

“If we are going to help our country grow the middle class, we have to find ways to add personal finance ecosystem experts and advice that will increase net worth and build generational wealth,” says Williams.