By Alexandre Tanzi

By the end of last year, more than 30 percent of U.S. homeowners were considered equity-rich — meaning their property was worth twice as much as the underlying mortgage, a report showed.

Helped by low interest rates, the count of equity-rich properties in the fourth quarter of last year rose to 17.8 million of the 59 million mortgaged homes in the U.S., according to the ATTOM Data Solutions fourth-quarter 2020 U.S. Home Equity & Underwater Report released Thursday. That’s up from 26.7 percent in the fourth quarter of 2019.

“The housing market kept booming despite damage caused by the virus pandemic to the broader economy,” said Todd Teta, ATTOM’s chief product officer. “Homeowners are sitting pretty on a growing reserve of personal wealth.”

Nationally, the S&P CoreLogic Case-Shiller index gained 9.5 percent in November, the most since 2014.

The rise in values is also helping to reduce the number of seriously underwater properties. These types of homes — defined as having a combined balance of loans secured by the property at least 25 percent more than its market value — have fallen by a full percentage point over the past year. They now account for 5.4% of mortgaged U.S. properties.

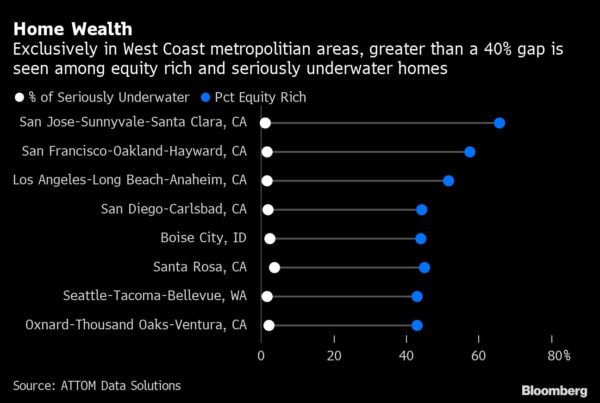

In six states — Louisiana, Mississippi, West Virginia, Iowa, Arkansas, and Illinois — the percentage of underwater homes remains above 10 percent. In Vermont and California the gap between equity-rich homes and those that are underwater is at 44.7 percent and 43.6 percent, respectively. Among metropolitan areas, only in Baton Rouge, Louisiana, is there a larger percentage of underwater homes than equity-rich ones.

Among 107 metropolitan statistical areas with a population greater than 500,000, the 10 with the highest shares of equity-rich properties in the fourth quarter were in the West, with the top five in California, according to the report.

At an even more granular level, 38 of the top 40 equity-rich zip codes were in California, and most of those were in the San Francisco area.

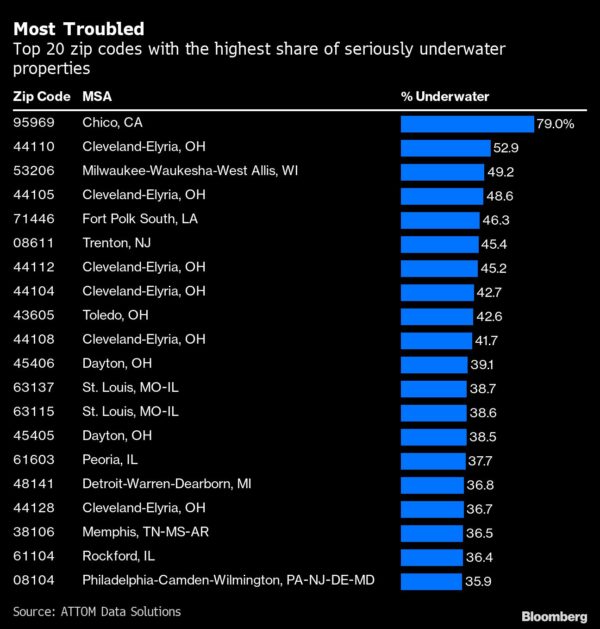

In 81 zip codes out of the 8,691 analyzed by ATTOM, at least a quarter of all properties with a mortgage were seriously underwater. Nine of the 20 worst were in Ohio, mostly in the Cleveland area.

For more articles like this, please visit us at bloomberg.com.