By Emily Cadman and Alice Kantor

Homeowners are taking advantage of a global housing boom by pulling equity out of their homes at the highest volume since the financial crisis.

In the U.S., homeowners withdrew $63 billion in equity from their properties through more than 1.1 million cash-out refinances in the second quarter of the year — the largest quarterly volume since mid-2007, according to data company Black Knight. Just under one in five American homeowners say they have pulled money out of their properties in the last year, according to a survey in late October by market research firm Harris Poll, with another 18% saying they are considering it.

Homeowners elsewhere are also finding the idea attractive. In the U.K., net equity withdrawals topped 13 billion pounds ($18 billion) in the first half of the year. That’s the first time since 2008 that Britons took out additional equity instead of injecting cash into their homes, according to Bank of England data.

Mike Reed, the founder of a copywriting agency in London, was one of them. He remortgaged his three-bedroom apartment near Wimbledon earlier this year to fund a kitchen and bathroom remodel. In part, “it’s something I want for myself,” he said. The 51-year-old also believes the value added to the property — which he paid 655,000 pounds for two years ago — will make up for the additional debt.

With borrowing costs at rock-bottom levels, he was able to tack on 30,000 pounds to his mortgage at a 1.54% rate, fixed for five years.

“I’m conscious that there is a risk, I can’t guarantee that the value will go up to cover the extra expenses,” Reed said. “But living in London, I’m confident that prices will creep up.”

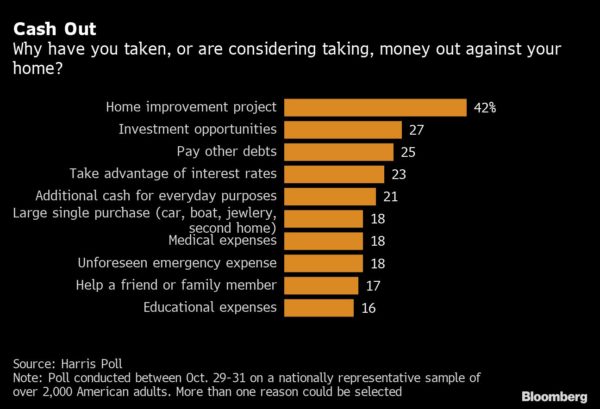

Harris Poll’s survey showed that like in Reed’s case, the top reason to access cash for Americans was to fund home improvement projects. Other investment opportunities and paying down debts followed.

An astonishing surge in home prices over the last 18 months has convinced other homeowners to do the same. Plus, ultra-low interest rates are making it possible to secure cash-out refinancings and end up with the same — or sometimes lower — monthly mortgage payments.

While taking advantage of the extra cash may seem like a no brainer, it’s far from a risk-free option. Homeowners are ultimately increasing the debt load on their property and shrinking their available equity. If housing values were to fall, that could leave them owing more than their property is worth or with too high a loan-to-value ratio to refinance down the line.

A home or ATM?

Home-equity loans had their heyday in the run-up to the financial crisis. Tempted by climbing values, homeowners used their properties as virtual ATMs to fund everything from fancy vacations to jet skis. When values crashed, borrowers saw their supposed equity vaporize.

While equity withdrawals have jumped, they are way off the heights of those boom years. Americans cashed out $101 billion of equity in the third-quarter of 2005, according to Black Knight, nearly $40 billion more than in the most recent quarter. At the same time, average national home values are now roughly 57% higher than in 2005.

Economists are keeping a close eye on the increases but are so far relatively sanguine, partly because of other consumer credit signals. Overall spending remains muted and credit card debt has fallen, suggesting that people remain fiscally cautious and aren’t embarking on a consumption binge.

“We’re not too worried about this being a sign of excess,” said Paul Dales, chief UK economist at consultancy Capital Economics. In an era of working from home and a dash for space, withdrawing equity “may be completely rational if they are investing it by expanding their current home.”

The consultancy also points out some of the surge will be a result of “accidental” home equity withdrawal, like when a mortgage is paid off and cash leaves the housing chain. The value of the money exiting will increase when sales volumes and prices boom.

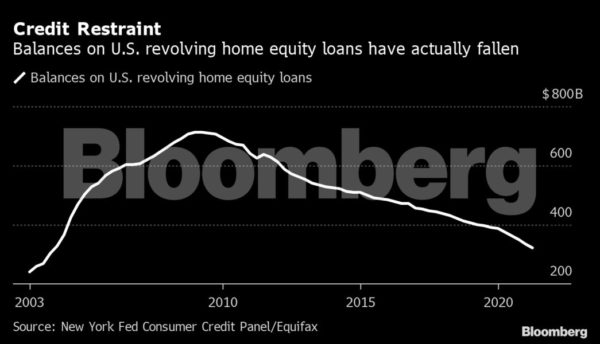

What’s giving comfort to economists is the most ATM-like form of borrowing — revolving lines of credit, which usually carry variable interest rates — have actually dropped in the U.S., according to New York Federal Reserve data, indicating consumers aren’t just tapping into equity to top-up everyday spending. Though some big banks, including the likes of Wells Fargo, did suspend new applications for home equity lines of credit in pandemic.

That doesn’t mean that everyone is being sensible. Popular personal finance blogger Sam Dogen — AKA Financial Samurai — says several of his followers have asked whether they should remortgage to invest in cryptocurrencies.

“I tell them ‘no’,” he said. “Taking on debt to invest in a non-guaranteed return asset, like crypto, is a red flag. I wouldn’t do that.”

A believer in the long-term potential of the housing market though, Dogen has himself jumped in, taking out a $1.6 million mortgage on his San Francisco house at a 2.25% interest rate to buy a second home nearby. He has moved into the new house, which is larger, and is considering using the other as an investment property.

That’s more in line with what most financial planners recommend.

“Using it [equity] to provide funding for long-term assets like starting a business, renovating your home or as leverage to buy another long-term asset such as a second home or investment property makes sense,” said Susan Mitcheltree, a partner at wealth management firm Berman McAleer in Maryland. “Using it to fund a short-term asset purchase like a car or to pay off temporary debt makes less sense.” Otherwise you could find yourself paying for an asset long after it’s gone.

Other advisors are more bullish about using equity for a range of purposes. “You can’t eat your home,” Dennis Nolte, a financial advisor with Seacoast Investment Services in Florida said, pointing out that some people are better off having liquidity than the equity. Still, with “values at all-time highs it’s time for consideration.”

His client, 60-year-old Becky Newman, is looking to do just that. Having paid for $250,000 in cash for her three-bedroom Orlando townhouse two years ago, Newman says she now wants to take advantage of the robust housing market to make money.

The retired communications expert plans on taking out a loan that’s 80% of the value on her house, now appraised at $330,000, at a roughly 2% rate, to invest in the stock market and mutual funds, where she hopes she can get at least 5% in returns.

“I’ve always believed in having no debt whatsoever,” she said. “But now there’s an opportunity to leverage the lower [borrowing] interest rates and invest.”

Borrowers, Beware

While pulling money out can make sense for the right opportunity, it’s not something to be done lightly, said Ashley Folkes, a financial advisor at Bridgeworth Wealth Management in Alabama.

For example, not all renovations can actually improve the value of a home, or people may merely find themselves shifting around debt rather than repaying it.

“We are not always rational with our decisions,” Folkes said, and suggested that homeowners should always seek a second opinion.

Taking on more debt makes homeowners more vulnerable to income shocks, increasing the risk of foreclosure. If prices fall, it can also leave them owing more than their property is worth.

Taking on a home-equity loan to fund an investment requires a high risk tolerance, according to Matt Chancey, a financial planner in Tampa, Florida. And the likelihood of regret is greater if the cash out is funneled into short-term investments.

“Unfortunately, Americans try real hard not to make good financial decisions,” he said of owners who tap equity to fund cars or trips. “Longer term that will not work out in their favor.”

More stories like this are available on bloomberg.com.