By Suzanne Woolley

A rule of thumb for how much U.S. retirees can “safely” withdraw each year without fear of outliving their savings just got a haircut.

People retiring in the next few decades should only count on withdrawing 3.3% of their savings a year, down from the well-established number of 4%, when planning to live about 30 years past retirement, according to a Morningstar Inc. report published last week.

For someone with a $1 million portfolio, that’s a slide from $40,000 a year to $33,000. With pensions a perk of the past and Social Security benefits at risk of being cut, there’s not much of a safety net for people who run out of their own savings.

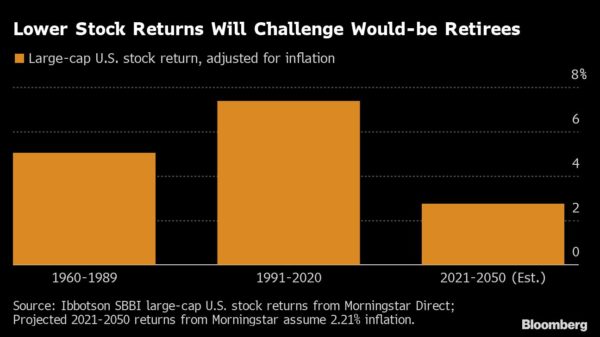

While people retiring in the past 15 years or so had a tailwind, today’s retirees face headwinds. “Current conditions demand greater forethought and planning than in the past, when lower valuations and loftier yields paved the way to higher future returns,” the report said. Morningstar Investment Management’s 30-year inflation-adjusted return forecast for U.S. large-cap stocks is 2.74%. The forecast for investment-grade bonds is -0.11%.

The 4% rule came from a 1994 study that looked at every rolling 30-year period since 1926. It found that retirees with portfolios made up of 50% stocks and 50% bonds could tap an annual amount equal to 4% of their original pot of money, adjusted for inflation, without risk of outliving their money.

Now, 3.3% — which Morningstar said is conservative — is less of a suggestion than a starting point. Most financial planners recommend retirees take a flexible approach, maybe taking out more after the market had a good year and less when the market’s down. That tends to lead to people spending down most of their money before they die. Sticking to a fixed-percentage withdrawal can leave more for heirs, the report found.

“The key to all of this is that for most retirees it’s a little bit of a mosaic,” said Christine Benz, Morningstar’s director of personal finance. To get a higher safe withdrawal rate, “maybe you delay claiming Social Security for two years, maybe you don’t take a full inflation adjustment every year,” she said.

As well, retirees will want to be strategic about which accounts they withdraw money from each year, since “if portfolio returns are lower, managing for taxes will be more meaningful,” said Benz.

More stories like this are available on bloomberg.com