By Srinivasan Sivabalan and Emily Graffeo

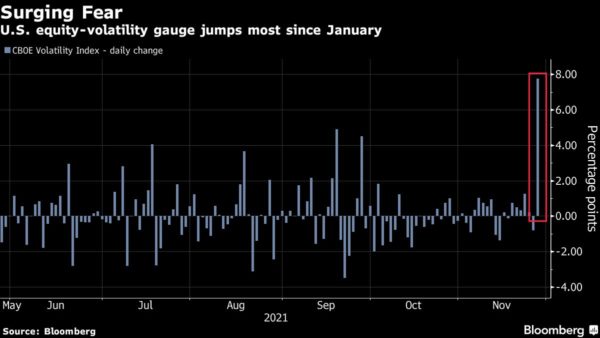

U.S. stocks slid as a post-Thanksgiving selloff spread across global markets amid fears a new coronavirus variant identified in South Africa could spark fresh outbreaks and scuttle a fragile economic recovery. Haven assets surged.

Equity benchmarks dropped across the board, with cyclicals and small-caps taking the brunt of the selling. The S&P 500 Index extended declines falling more than 2% while the Russell 2000 sank more than 4%. Travel and leisure stocks tumbled, while stay-at-home shares gained. That helped ease losses in the Nasdaq 100, which was still down 1.8%. Oil tumbled through $70 a barrel in New York for the first time since late September.

Treasuries jumped on haven bids, sending the 10-year yield down as much as 14 basis points, the most since March 2020, while traders pushed back bets on the Federal Reserve hiking rates. The Japanese yen emerged as the main haven currency of the day, with the dollar falling.

The World Health Organization and scientists in South Africa were said to be working “at lightning speed” to ascertain how quickly the B.1.1.529 variant can spread and whether it’s resistant to vaccines. The new threat adds to the wall of worry investors are already contending with in the form of elevated inflation, monetary tightening and slowing growth.

“This is not trivial,” said Jay Hatfield, chief executive and founder of Infrastructure Capital Management. “So it makes sense for people to rebalance because there’s tons of uncertainty and that’s never good for buying stocks.”

Carnival Corp. and Royal Caribbean Cruises Ltd. lost at least 9% each while United Airlines Holdings Inc. dropped 10%. Zoom Video Communications Inc. and Peloton Interactive Inc. were up at least 5%.

“It’s terrible news,” Ipek Ozkardeskaya, a senior analyst at Swissquote, said in emailed comments. “The new Covid variant could hit the economic recovery, but this time, the central banks won’t have enough margin to act. They can’t fight inflation and boost growth at the same time. They have to choose.”

The selloff comes after global markets adopted a Jekyll-and-Hyde posture for months, with equities rallying to newer records even as concerns intensified over a toxic combination of high inflation and slower growth. Investors poured almost $900 billion into equity exchange-traded and long-only funds in 2021 — exceeding the combined total from the past 19 years.

“At these valuations any sort of headline is going to cause this pullback,” Brian Vendig, MJP Wealth Advisors Pdresident, said in an interview with Bloomberg TV. “You definitely don’t want to be 100% in risk assets — whether its interest rate risk, inflation risk, policy risk and now another cue for the health-care crisis letting us all know we’re not out of the pandemic.”

Rate Wagers Cut

Traders pushed back the expected timing of a first 25-basis-point rate increase by the Federal Reserve to September from June, while briefly pricing out any more hikes unit 2023.

They also bet on less than a 10-basis-point hike by the Bank of England next month, compared with 35 basis points projected a month ago. They called for seven basis points of tightening by the European Central Bank by December 2022 as against nine basis points seen Thursday.

The yen and Swiss franc found bids from safety-conscious traders, while the dollar posted a modest loss. A gain for the euro, the biggest component of the Bloomberg Dollar Spot Index, also curbed the greenback.

MSCI Inc.’s Asia-Pacific equity gauge slid to the lowest since early October, with Japan and Hong Kong gauges dropping at least 2% each.

Some of the worst-hit assets were in emerging markets. The currency of South Africa, where the virus strain was identified, lost 1% and the Turkish lira dropped 2.4%. The MSCI EM Currency Index fell to a six-week low.

While the selling continued unabated, some investors said it’s important not to get carried away by short-term jitters.

“Markets have had a very strong run over the last 12 months and so it is no surprise to see a reaction like this,” said Dan Boardman-Weston, chief investment officer at BRI Wealth Management. “If this is going to take the world backward from a Covid perspective, then it’s likely that inflation will abate and monetary policy will stay looser for a long time which is likely to be a positive for markets in the medium term.”

Some of the main moves in markets:

Stocks

- The S&P 500 fell 2.2% as of 11:16 a.m. New York time

- The Nasdaq 100 fell 1.8%

- The Dow Jones Industrial Average fell 2.7%

- The Stoxx Europe 600 fell 3.5%

- The MSCI World index fell 2.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 1% to $1.1318

- The British pound was little changed at $1.3330

- The Japanese yen rose 1.8% to 113.24 per dollar

Bonds

- The yield on 10-year Treasuries declined 15 basis points to 1.48%

- Germany’s 10-year yield declined nine basis points to -0.34%

- Britain’s 10-year yield declined 15 basis points to 0.81%

Commodities

- West Texas Intermediate crude fell 12% to $69.22 a barrel

- Gold futures rose 0.7% to $1,800.30 an ounce

More stories like this are available on bloomberg.com