By Kriti Gupta

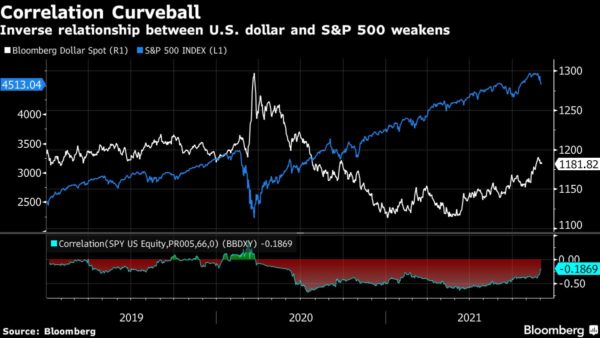

Call it the new, new normal in the trading relationship between the U.S. dollar and stocks. Equities volatility and the hedges that come with it are dictating flows in the U.S. currency, not the other way around.

“The dollar has become of one of the last hedges that are really working in this environment,” Russ Koesterich, Blackrock Global Allocation Fund Portfolio Manager, said in a Bloomberg TV interview. “It has become fairly negatively correlated with stock.”

Koesterich, who’s overweight on the dollar, added that “where the market is getting hit by rate volatility, which has happened more in the last six-to-eight months, the dollar has generally worked as a hedge.”

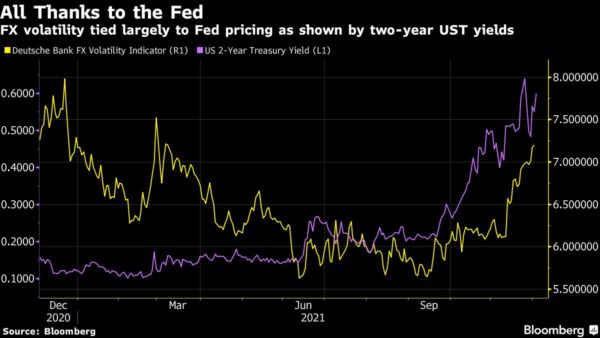

The greenback has more recently been moving in line with interest rates, rather than reacting to haven flows and bids for U.S. assets the way it did early in the pandemic. The Deutsche Bank FX Volatility indicator has been moving more closely with two-year Treasury yields, which is usually used to price in Federal Reserve moves. As bets on rate hikes rise in anticipation that the Fed will address U.S. inflation that’s outpaced its global peers, so have yields, and with them the dollar.

Since Fed Chairman Powell suggested earlier this week that it’s best to retire the word “transitory” in describing inflation and that he’s open to speeding up the central bank’s tapering of bond purchases, yields on the front end of the Treasury curve have climbed 10 basis points. Meanwhile, the 5s30s curve has flattened, suggesting the premium investors get for taking on more risk is narrowing — a move that’s accelerated since the Black Friday stock market sell off.

On Wednesday, the VIX shot to its highest level since January, when meme-stock mania rocked markets. In response, there have been outsized moves in the euro, British pound and even emerging market currencies, all of which are counterintuitive to the macro, risk-off narrative. Volatility has been wreaking havoc for portfolio managers who want to hedge FX against outstanding equity positions, which explains the fluctuating flows into the dollar and its ripple effects.

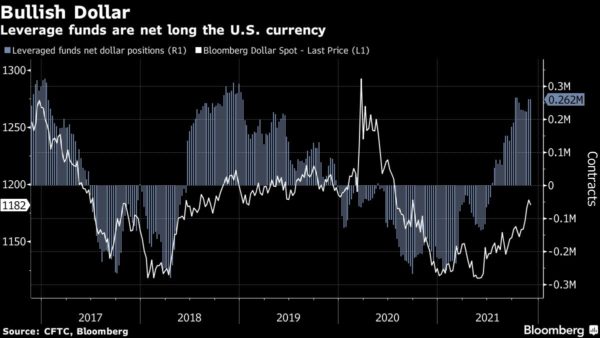

“We had big stop outs in short euro positions against the dollar since Friday,” said Jens Nordvig, founder of Exante Data. “The market was caught very long the U.S. dollar versus the euro and the Japanese yen.”

More stories like this are available on bloomberg.com.