“When I was growing up, it’s either you sell drugs, play basketball or you rapped; that’s no longer true for Black kids, there’s too much opportunity out here,” said Reco Oxendine, an entrepreneur and financial literacy advocate in the Philadelphia suburb of Coatesville, Pennsylvania.

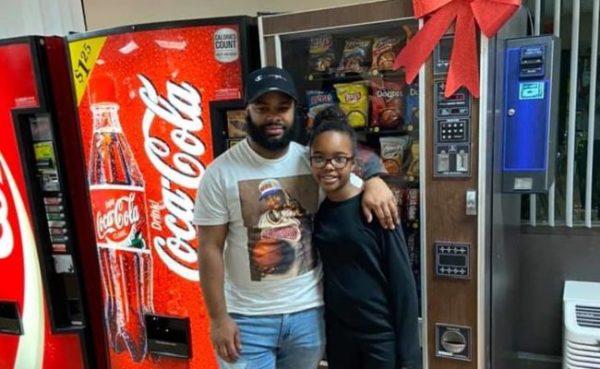

Oxendine has made building generational wealth and closing the racial wealth gap core pillars of his existence. He began with his daughter, Amya Oxendine, 12, by selling candy at local events, barbershops and hair salons using a wagon, and as their candy-selling business grew they went from pulling wagons to using their own vending machines.

“I never thought I would buy a vending machine, I just wanted to learn how to make money myself and with my child,” Oxendine said.

In December 2019, Oxendine gifted his daughter her own vending machine, and fortunately for the then-12-year-old, the pandemic-related shutdown had little impact on her machine, which was housed in an apartment building for senior citizens. Oxendine says the biggest challenge was keeping the machine stocked with products due to COVID-related restrictions throughout 2020 and early 2021.

Amya earned around $3,500 so far from the two vending machines she now owns. Oxendine runs a cellphone repair shop as well as his family’s five vending machines, and he admits occasional challenges keeping his daughter focused on the mechanics of running her vending machines, including keeping them stocked, monitoring the profits, and knowing which items sell best.

Oxendine says anyone with the right mindset to create passive income can be successful. He says individuals must first have a desire to build wealth through entrepreneurship. Second, they have to build relationships with other entrepreneurs and businesses to leverage their assets. In Oxendine’s case, he was able to place his vending machines in the barbershops and hair salons he once sold candy to out of his wagon. Third, would-be entrepreneurs must learn and perfect their craft. Oxendine learned about vending machines and understood maintenance costs. Lastly, park your money in stocks or investment accounts.

Oxendine believes in order to close the racial wealth gap and build wealth, African-Americans must learn to overcome a “poverty mindset.”

“We have to think about how we think about money and how we view time, because a lot of us live in survival mode, so you can’t even talk to your grandmother about stocks and stuff because they’ve lived in survival mode for so long that they’ve passed down that poverty mindset,” Oxendine said.

Read full story on Atlanta Black Star here.