By Alex Tanzi

A central part of the “American Dream” is to buy a house, pay it off over time and retire with hundreds of thousands of dollars of equity in the home.

Student-loan burdens are upending this scenario, according to a study from the Jain Family Institute that found the rise in student debt has become a major obstacle to purchasing a home — especially among relatively high-income young borrowers.

The research brings into question the value of a college degree. For young adults earning $100,000 or more, higher student debt corresponds with lower homeownership in each year of the 10-year study.

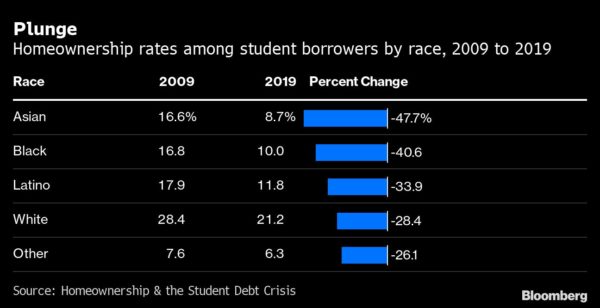

Overall, the rate of homeownership among student borrowers age 18 to 35 has dropped 24% in the decade through 2019, the report shows. People living in Black and Asian communities saw the biggest declines — even as they started with the lowest rates back in 2009.

Owning a home has traditionally played a key role in building financial security for millions of Americans. In 2019, homeowners had a median net worth of $255,000, compared with $6,300 for renters or others, according to a 2020 Survey of Consumer Finances from the Federal Reserve.

Researcher Eduard Nilaj, author of the Jain report, said by email that the freeze in student-loan payments since the beginning of the pandemic — recently extended by another three months — may have enabled some mid- and high-income student-loan borrowers to buy a home. But the surge in house prices has also been a deterrent.

Only debt cancellation or a large reduction in interest rates would likely make an impact on home ownership.

As the pool of Americans attending college increases, the average student borrower is getting poorer, Nilaj found. And as higher-education fees have increased, so have the amount of student loans.

From 2009 to 2019, the median estimated income of student debtors in the Jain sample shrank to $67,364 from $82,765. At the same time, the share of people with outstanding student-loan balance of $25,000 or more soared.

“Rather than paying a mortgage for a house, young people pay student-loan debts that are mortgage-like, both in the scale of outstanding balance and length of term,” Nilaj, who tracked more than 800,000 student-loan borrowers, wrote in his report. “While a decline in homeownership is just one of the many concerning trends shaping the lives of young Americans, its pervasiveness may signify a new normal.”

More stories like this are available on bloomberg.com.