By Claire Ballentine

British fund manager Terry Smith is steering clear of the rotation into value stocks and companies that will benefit from economic reopenings.

The head of the giant Fundsmith Equity fund at Fundsmith LLP said in his annual letter to investors that timing the market when such equities will outperform is difficult. Additionally, the market may have already priced in the benefits of post-pandemic economic reopenings for firms such as airlines and hotels.

“On the whole the return characteristics of businesses persist,” he wrote. “Good sectors and businesses remain good and poor return businesses also have persistently poor returns.”

Famous in the U.K. among retail investors, Smith’s fund returned about 18.6% in 2021 and holds 28.9 billion pounds ($39.4 billion), according to the firm’s website. His personal profit was about 35.6 million pounds ($48.6 million).

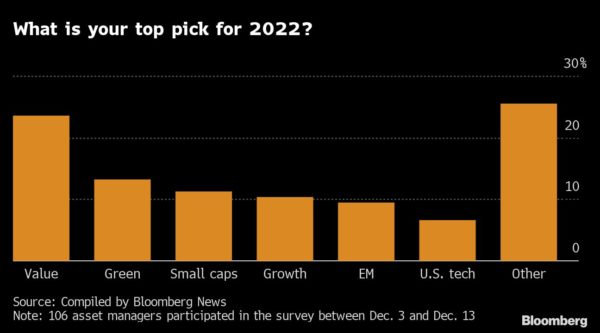

Smith’s view is in contrast to other fund managers, who view value equities — which are inexpensive relative to earnings — as an attractive investment prospect versus so-called growth stocks (relatively more expensive but faster-growing companies like tech firms) for 2022. While the two styles globally returned about 20% each in 2021, growth stocks far outperformed value in the U.S. Prior to that, growth stocks around the world typically have done better over the past few years.

Over the past few months, as more people around the world have received Covid-19 vaccine shots, companies that benefit from a return to normalcy like airlines and hospitality firms have risen when there’s positive news about the pandemic. Shares of tech firms that typically benefit from stay-at-home policies have been hit.

Smith says following that trend isn’t a prudent idea. “Even if you manage to identify a truly cheap value or reopening stock and time the rotation into that stock correctly so as to make a profit, this will not transform it into a good long term investment,” he said.

For 2022, Smith predicts that we may have “all the ingredients for inflation to take hold.” However, the companies in his fund — such as L’Oreal SA — will be better able to weather inflation because of their higher gross margins, he said.

The top five contributors to the Fundsmith Equity fund in 2021 were Microsoft Corp., Intuit Inc., Novo Nordisk A/S, Estée Lauder Cos Inc. and IDEXX Laboratories Inc. The bottom five were PayPal Holdings Inc., Amadeus IT Group SA, Kone AG, Unilever Plc and Brown-Forman Corp.

More stories like this are available on bloomberg.com.