By Elizabeth Stanton

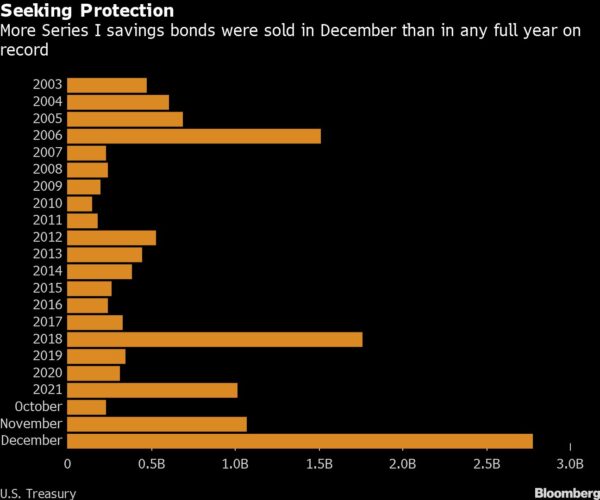

American savers piled into inflation-protected savings bonds, scooping up more in December alone than they had for any full previous year, as consumer prices soared across the U.S.

The government sold $2.78 billion of Series I savings bonds, which pay a fixed interest rate plus inflation, in the month after selling $1.07 billion of the bonds in November, according to Treasury Department data.

The December figure is $1 billion more than the previous full-year record, which came in 2018, when a jump in oil prices drove inflation toward 3%. Annual inflation is running now at a four-decade high of 7%, the result of booming consumer demand and supply-chain snarls sparked by the pandemic.

The government began selling Series I bonds in 1998. The fixed interest rate, which is set for new bonds every six months, has been 0% since May 2020. That has done little to discourage buyers, though, because the inflation component of the bonds, which also resets twice a year, is currently paying out an annual rate of 7.12%.

Demand, in fact, would be up even more if it weren’t for the hard cap the government puts on on-line purchases of the securities — $10,000 per person per year.

More stories like this are available on bloomberg.com