Black people in the U.S. suffer from a widening economic gap in homeownership, education, income and wealth when compared to their white counterparts.

Most of these gaps have been studied and documented by different government agencies or think tanks. In an attempt to bring all that research together under one quick reference, Morningstar published a visual breakdown of some of the biggest wealth gaps plaguing the U.S.

In one graphic, Morningstar notes that the average white household brought in almost $75,000 in wages in 2020, compared to about $46,000 for Black households, according to the U.S. Census.

“Income gaps between races in America make it much more difficult for people of color, particularly across generations, to build more wealth,” Morningstar editor Keith Reid-Cleveland noted.

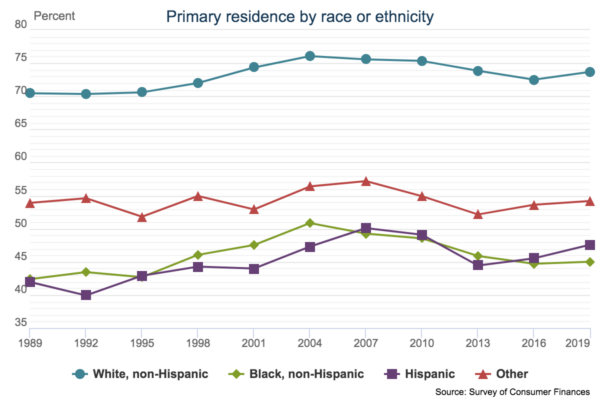

A survey from the Federal Reserve found that 45 percent of Black people own their homes, compared to 75 percent of whites. There’s also a gap in home values, with Black appraisals averaging $150,000 and those of whites at $230,000.

That gap exists because Black people were not given access to the same quality mortgages as white people had decades ago, said University of Pittsburgh historian Keisha Blain.

“Access to quality housing has not improved, and there are still many barriers that people of color face when seeking mortgages,” Blain wrote in an opinion piece for MSNBC. “The mechanisms might have changed over time, but the end result is the same: Homeownership for Black Americans and other people of color is an uphill battle. And it’s unlikely to change anytime soon — especially if the federal government doesn’t make change a priority.”

The wealth gaps between Black and white Americans are so large that it’s dragging down the U.S. economy by trillions of dollars, a 2020 study from Citigroup found. A McKinsey study found that giving Black workers equal pay in about 20 jobs like accountant and software developers would close the income gap by half.

Economists and researchers have said it will take aggressive federal policy changes to make a dent in the U.S. wealth gap.

“The most straightforward approach is for the federal government to provide money to descendants of American slaves,” Brookings fellow Vanessa Williamson said in a 2020 policy paper.

Morningstar also noted that Black Americans are saddled with much more student loan debt and have fewer dollars saved for retirement. Black people who leave college with a bachelor’s degree average almost $53,000 in student loan debt, compared against $28,000 for whites, Morningstar said, citing 2016 data from the Brookings Institution. White households in 2019 had on average $80,000 socked away for retirement compared to $35,000 for Black households, the Morningstar graphic showed.