By Claire Ballentine and Paulina Cachero

Real estate bidding wars are breaking out, new listings are disappearing within days and prices are expected to rise even further. What’s a prospective homebuyer to do?

For many, the answer is purchasing a cheaper home in need of renovation. Discouraged by the unrelentingly hot U.S. market, first-time and experienced buyers alike are betting that the effort and cost of fixing up a home will be a better investment in the long run.

What sets this generation of renovators apart from HGTV devotees — inspired by the likes of Chip and Joanna Gaines of “Fixer Upper” — is that it’s no longer a matter of buying the worst house on the best block. High prices are pushing people past the boundaries of their first-choice neighborhoods, further out of cities and deeper in the suburbs. As is, home values are projected to rise 14% through November, inventory is at a record low, and even with interest rate hikes on the horizon, mortgage rates are still historically low, enticing new entrants into the market.

“When everyone else is looking for a move-in ready home, there’s less competition for the fixer-uppers,” said Daryl Fairweather, chief economist at Redfin Corp. “I would not advise it for the faint of heart, but there are a lot of people who are willing to take on that risk because there is such a high reward.”

In 2021, homes in need of renovation sold at a faster pace than the two prior years, according to data from Realtor.com. Fixer-upper sales jumped 13.4% from 2020 to 2021, while the dollar volume of those deals surged 40.8% from 2019 to 2021, reflecting the high growth in sale prices across the broader market. Plus, listings described as “fixer-upper” or using other related terms by agents increased by 8% in December from the previous year.

No matter the budget, it’s far from a foolproof plan. The supply chain crisis has not spared building materials, the construction industry is facing a shortage of workers, and inflation is pushing up the costs of almost everything. It’s a sticky spot for some homebuyers: They’re essentially forced into a fixer-upper because of their lower budgets, but external market forces are resulting in increased prices for those renovations.

“For first-time buyers, what would have been a more approachable pathway into homeownership before is now an extremely competitive space,” said George Ratiu, senior economist at Realtor.com. “With the significant jump in materials and labor costs we’ve seen in the last two years, the prospect of tackling a remodeling project in this period might be a little more of a challenge.”

‘Time And Energy’

Alex Maceda always thought she would buy a home in the Bay Area, where she grew up. But the 32-year-old artist and writer could hardly find anything below $1 million, far outside her budget.

So she turned south to Joshua Tree, a small community outside Palm Springs, which had a larger supply of reasonably priced homes. She settled on a two-bedroom, one-bathroom fixer-upper that spans about 1,000 square feet on a quarter acre. The cost for the house was about $270,000 before renovations.

“I didn’t have a lot of money, but I did have time and energy,” she said. “I thought, why not look at houses that are cheaper and could really be something special if I put energy into it?”

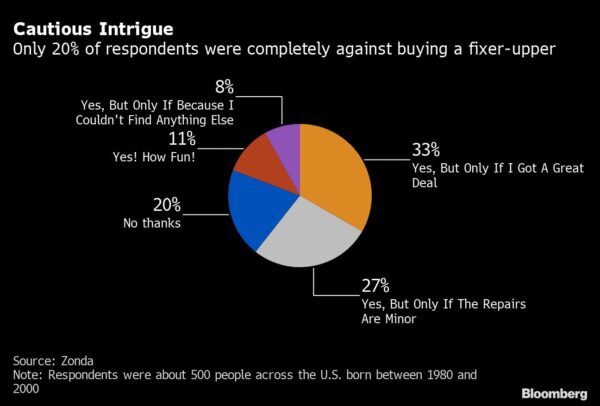

In a survey by housing research firm Zonda, 33% of respondents said they would buy a fixer-upper for their first or next home but “only if I got a great deal.” Meanwhile, 27% said they would “if the repairs are minor.” Just 20% responded with a “no thanks.”

Some of the hesitancy may be because fixer-uppers are unpredictable. In Maceda’s case, the issues in the 50-year-old house appeared mostly cosmetic at first — old carpets in the bedroom, tiles peeling off, chipped paint. Then, unanticipated problems started popping up. Maceda had to replace the propane tank, the air conditioning and heat system and the stove. So far, she’s spent about $8,000 on renovations, mostly through DIY and manual labor. Still, since Maceda had long dreamed of designing her own home, she sees it all as a way to add her own artistic touch to the property.

“There’s this national love affair that we have with old houses and their potential for dramatic transformations,” said Amanda Pendleton, home trends expert for Zillow Group Inc. “We’ve all been hardwired by home improvement TV to believe that buying a fixer-upper is a financial savvy thing to do.”

On average, fixer-uppers cost 13% less than their move-in ready counterparts, or are about $40,000 less than the typical U.S. home value, according to Zillow. But if that home needs $80,000 to make it livable, that’s not such a great deal, Pendleton said. She recommends that those fixing up homes add an extra 20% onto their budget as a cushion for the unforeseen.

Heavier Lifts

Not everyone can tackle fixer-uppers on their own — and a shortage of construction workers is putting some homeowners in a tough spot.

That’s what has delayed renovations for Craig Murphy, a 40-year-old tech worker, and his wife, Willow.

The pandemic put a dent in their finances — Willow wasn’t able to open her new acupuncture practice because of Covid lockdowns — so they took their home search out of San Francisco and over to San Rafael, north of the city. They bought a $1.25 million Victorian originally built in 1878, and set aside $800,000 for a two-phase renovation. A shortage of workers had put the first phase — painting, residing, fixing electrical issues — behind schedule by about seven weeks. Lumber prices also made work on the roof more expensive, and supply chain issues tacked on another three weeks. The couple will embark on the second phase, which involves installing a new foundation, after they refinance at a later date.

“We all thought the market would cool off, but everything I’m hearing is that the prices are going up because everyone is trying to lock in low interest rates,” Murphy said. “Fixer-uppers then become what’s available.”

For many homeowners like Murphy, finding hired hands to actually complete the work has been challenging. Shortages have been plaguing the construction industry, sometimes because there’s too much work or because there aren’t enough workers with the necessary skills. Even when Murphy finally found a contractor and crew, several of the workers contracted Covid, tacking on further delays.

The rising cost of materials — due to both inflation and supply shortages — can further complicate matters. Increased lumber prices in the past four months have caused the price of an average new single-family home to rise by more than $18,600 on average. And supply chain experts are forecasting another challenging year for acquiring goods.

“We’ve been having trouble getting materials in time, so there’s a delay on my projects,” said Elisa Covington, a real estate developer who flips homes in the Bay Area. That’s especially been the case for windows, tiles and cabinets, she added.

Risky Venture

The dream of fixing up an older home can sometimes turn into a nightmare, like for Andrew Nguyen. The 31-year-old and his fiancé began the hunt for a four-bedroom home in their hometown of San Jose with high hopes and a budget of $1.1 million to $1.5 million.

Last summer, the couple was ready to bid $50,000 to $100,000 over the $1.2 million asking price on a quaint, single-family home built in the 1970s. However, an inspection report showing that the house had major structural damage and leaks made them reconsider.

“We thought it would just be simple, cosmetic changes,” Nguyen said, noting that his real estate agent estimated the renovations would cost them a minimum of $400,000. “But after seeing the inspection report, that’s when we had to contemplate, ‘Is this really worth it? Is this still something that we think we can really afford?’”

The couple backed out, and later closed on a nearby five-bedroom, move-in-ready home listed at $1.45 million — a deal they only secured because the previous owner turned down higher bidders in order to pass the property onto buyers planning to raise a family.

Inspections are a crucial step in the homebuying process, especially when it comes to older homes. And even for people who set aside generous budgets for significant renovations, a property’s problems could be worse than they initially appear.

“Understand if there are major issues with the foundation, structural issues with the building, or any repairs that could result in unexpected costs, especially if you have a strict budget and financial constraints,” said Realtor.com’s Ratiu. “Repair costs can be tens of thousands of dollars and that could be a potential deal breaker.”

The New HGTV

For those who do take the plunge on a fixer-upper, there’s a whole community behind them. Alongside the traditional home improvement shows on channels like HGTV, there’s a new crop of YouTube and TikTok influencers who document projects for their followers.

Adam Miller, a 37-year-old in North Carolina, runs “Old House Adam,” which has 1.7 million followers on TikTok. His home upgrades run the gamut, from updating a lackluster pantry to completely gutting and renovating abandoned homes. @oldhouseadam

Recap time for those who are new or forgot the last 6 months. #restoration #renovate #oldhousetiktok #interiordesign #interiordesigner♬ BREATHE – Jérôme Cosniam

“People love seeing how other people do things that can inspire them,” he said. “And I think like before you had to go on HGTV or watch a really long YouTube video, but now I can give you all your serotonin in like 30 seconds. So it’s instant.”

Liz Lovery, a 32-year-old content creator in Chula Vista, California, has used her TikTok account — which has almost 900,000 followers — to document fixing up a home that she and her husband purchased for $705,000 last year. They moved in during the renovations, which they mostly did themselves. @lizlovery

Welcome to our chaos #justmarried #newlyweds #fixerupper #homerenovation #diyrenovation #diyproject #hgtv #interiordesign #homeimprovement♬ original sound – Kiera Lyons

Along with showcasing her improvements and sharing tips, she also reveals the difficult aspects of “living in the chaos” of renovations and repairs: living with the walls torn down, using flashlights when the lights were out and having to order Doordash delivery because the kitchen wasn’t in working condition. But the finished product is all worth it, she said.

“With the market these days, it’s becoming harder to own a home, and people are trying to find a way to tap into the market,” she said. “It’s fun to be able to do work on their home themselves and really channel their own Joanna Gaines.”

More stories like this are available on bloomberg.com.