By Cecile Gutscher

U.S. equities gained amid positive economic data and reports that Vladimir Putin is ready to hold talks with the government in Ukraine, following its invasion by Moscow-led forces Thursday.

The S&P 500 advanced, led by consumer staples, while the Nasdaq 100 reversed opening gains to trade lower. Benchmark West Texas Intermediate crude fluctuated near $92 a barrel. The Stoxx Europe 600 gained 2.8%.

China’s leader Xi Jinping told Putin he should negotiate with the government in Kyiv, while Russia’s top diplomat said talks hinged on Ukraine’s surrender. Moscow-led forces continued attacks on military and civilian targets for a second day after the U.S. and its allies imposed new sanctions on Russia.

Treasuries, the dollar, and gold all retreated, signaling flagging demand for havens. Sentiment in the U.S. was also lifted after stronger-than-expected January data on income, personal spending and durable goods orders.

“Investor reaction to situations such as this are usually both severe and short-lived. We anticipate investors will eventually look past the conflict and to underlying economic fundamentals again,” said Nikesh Patel, head of client solutions at Kempen Capital Management.

A prolonged conflict could deliver a major blow to global markets and slow the normalization of central bank policy that’s expected this year. Wall Street strategists cut their forecasts on European equities on concern that the war in Ukraine will hurt economic growth, with Goldman Sachs Group Inc. expecting virtually no full-year returns.

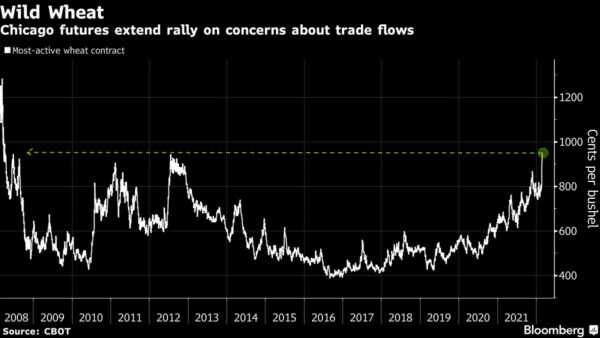

At the same time, disruptions of raw materials and food could stoke already-high prices and heap pressure on central banks to act faster to curb inflation. Russia remains a commodity powerhouse and Ukraine is a major grain exporter.

Markets still see around six quarter-point increases by the Federal Reserve, but bets on other central bank’s hiking cycles have been pared in recent days.

“This conflict implies a further deterioration of the already tricky growth-inflation trade-offs central banks have been facing, making the upcoming decisions particularly hard,” Silvia Dall’Angelo, senior economist at the international business of Federated Hermes, wrote in a note to clients. “Downside growth risks from the geopolitical backdrop mean that they are likely to proceed gradually and cautiously.”

Penalties by the U.S. and its allies spared Russia’s oil exports and avoided blocking access to the SWIFT global payment network. With flows of natural gas returning to Europe, prices reversed a record-breaking rally with the benchmark contract down as much as 31%.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.5% as of 10:08 a.m. New York time

- The Nasdaq 100 fell 0.3%

- The Dow Jones Industrial Average rose 0.8%

- The Stoxx Europe 600 rose 2.8%

- The MSCI World index rose 1.1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro rose 0.5% to $1.1245

- The British pound was little changed at $1.3389

- The Japanese yen was little changed at 115.56 per dollar

Bonds

- The yield on 10-year Treasuries advanced two basis points to 1.98%

- Germany’s 10-year yield advanced five basis points to 0.22%

- Britain’s 10-year yield was little changed at 1.45%

Commodities

- West Texas Intermediate crude fell 0.6% to $92.25 a barrel

- Gold futures fell 2.1% to $1,885.40 an ounce

More stories like this are available on bloomberg.com.