By Craig Torres

Federal Reserve Chair Jerome Powell backed a quarter-point interest-rate hike this month to commence a series of increases and didn’t rule out a larger move at some stage, despite uncertainty caused by Russia’s invasion of Ukraine.

“I am inclined to propose and support a 25 basis-point rate hike,” Powell told the House Financial Services Committee Wednesday. “To the extent that inflation comes in higher or is more persistently high than that, then we would be prepared to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings.”

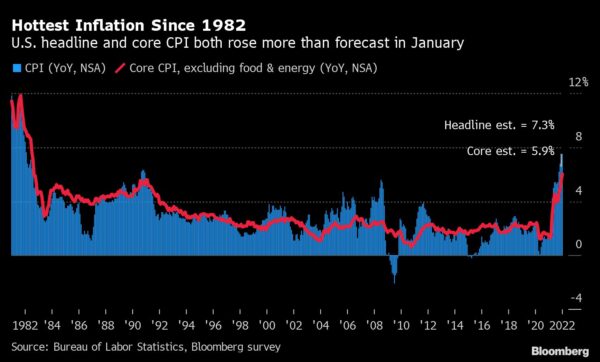

Fed officials are pivoting to tackle the fastest inflation in 40 years and a few have publicly discussed the potential need to hike by a half point some time this year if inflation comes in too hot. They get February data on consumer prices on March 10, five days before they start their next policy meeting.

While acknowledging the uncertainty posed by the attack on Ukraine, Powell said the need to remove pandemic policy support had not changed.

“The bottom line is that we will proceed but we will proceed carefully as we learn more about the implications of the Ukraine war for the economy,” he said.

Investors increased their bets on the pace of rate hikes this year as the Fed chief spoke, pricing in around 140 basis points of tightening starting this month — which will mark the first increase since 2018. U.S. stocks advanced and 10-year Treasury yields rose on Powell’s message that the economy is expanding with enough force to withstand higher borrowing costs.

Powell said the labor market is “extremely tight,” essentially a message to lawmakers that the central bank has met its maximum employment goal in current conditions, which opens the door to its inflation fight. He said employers are having difficulties filling job openings, while workers are quitting and taking new jobs, helping wages rise at the fastest pace in years.

“We know that the best thing we can do to support a strong labor market is to promote a long expansion, and that is only possible in an environment of price stability,” Powell said, restating a line he has used several times now that interprets the inflation fight in terms of preserving the expansion.

The Fed chief said it wasn’t clear how high rates would have to rise to get inflation under control, in relation to the so-called “neutral” level that neither speeds up nor slows economic activity.

“We talk about getting to neutral, which is a neutral rate which would be somewhere between 2% and 2.5%. It may well be that we need to go higher than that. We just don’t know,” he said, adding that he believed it was possible to deliver that tightening without causing a recession.

“I think that it is more likely than not that we can achieve what we call a soft landing,” he said. “They are far more common in our history than is generally understood.”

Russian Invasion

Financial markets have largely reeled since Russia’s invasion of Ukraine, sending energy prices jumping and potentially pushing inflation higher, even as heightened tensions cloud the outlook for global growth. Several Fed officials speaking since the invasion have said they are still inclined to act.

Powell said that the “near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain.”

“Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways,” he said. “We will need to be nimble in responding to incoming data and the evolving outlook.”

‘This is a shock of uncertainty and the experience in the U.S. is, uncertainty shocks don’t create recessions,” said Michael Gapen, chief U.S. Economist at Barclays Plc. “They may make people hit the pause button. Momentum can slow, but that is not the same thing as retrenching.”

Balance Sheet

The Fed chair gave no timing on balance-sheet reduction, a decision that is likely still pending for the Federal Open Market Committee. After rate increases start, trimming assets “will proceed in a predictable manner primarily through adjustments to reinvestment,” he said.

In terms of how long it would take to get the balance sheet back down to a more normal level, Powell said it would be in the range of three years.

Krishna Guha, head of central bank strategy at Evercore ISI, said this suggests caps on the balance-sheet rolloff of $70 billion to $80 billion a month.

“The Russia Ukraine crisis will likely not have a major impact on the Fed’s balance sheet plans, though it will influence when these are put in motion,” he and his colleague Peter Williams wrote in a note to clients.

Inflation Outlook

Powell said he continues to expect inflation to decline over the course of the year as supply constraints ease and demand cools off in the wake of waning fiscal support and higher interest rates.

That seems like a reasonable forecast, said Kathy Bostjancic, chief U.S. economist at Oxford Economics, though headline inflation is likely to rise further with increasing commodity prices resulting from the Ukraine war. “Clearly the risks are to the upside here,” she said.

Powell’s confirmation for a second term has been stalled by Republican opposition to President Joe Biden’s selection of Sarah Bloom Raskin to be vice chair for supervision. The Fed chair follows his remarks Wednesday with an appearance before the Senate Banking Committee Thursday.

The Fed’s preferred gauge of price movements rose at a 6.1% annual pace in January, triple the central bank’s 2% target. Demand remains strong with growth forecasts centering around 2.9% this year, according to estimates tallied by Bloomberg, while companies continue to add employees at a robust pace.

Dot Plot

Fed officials will release fresh quarterly estimates for interest rates and the economy at their upcoming meeting, offering some guidance for how far and fast they expect to tighten policy in the coming months. Some have signaled the Fed may have to act with more force to get price pressures under control.

“This situation calls for rapid withdrawal of policy accommodation in order to preserve the best chance for a long and durable expansion,” St. Louis Fed President James Bullard said in separate remarks Wednesday. “The FOMC may have to move more aggressively going forward if inflation increases or does not moderate as much as expected.”

Speaking at a seperate event, Chicago Fed President Charles Evans was more cautious, saying that while monetary policy is “wrong-footed” and needs to be moved toward neutrality, he isn’t expecting increases exceeding 25 basis points apiece.

More stories like this are available on bloomberg.com