By Ranjeetha Pakiam and Eddie Spence

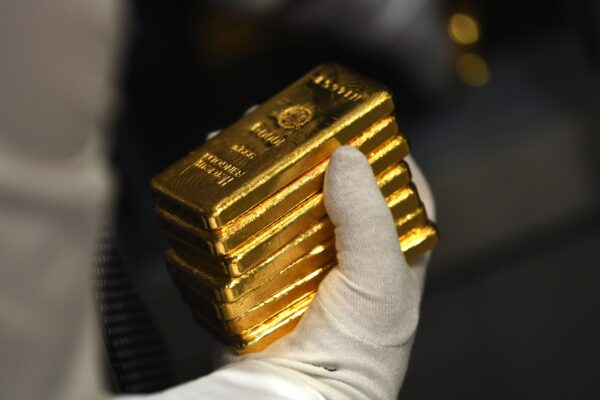

Gold declined for a third day as commodities continued a rout ahead of a key Federal Reserve meeting where policy makers are set to raise interest rates.

Bullion has eased after rallying to within $5 of a record last week as Russia’s invasion of Ukraine caused commodities to surge, threatening a combination of low growth and high inflation. Prices of key products including oil have cooled since then, easing those concerns.

Demand for gold as a hedge against higher consumer prices has helped fuel gains in the metal this year. Months of speculation about a new wave of rate hikes look to be coming to a head on Wednesday, when the U.S. central bank is expected to begin tightening. The Fed will seek to rein in decades-high inflation that’s being exacerbated by high commodity prices.

“Gold prices have moved lower in the past three days mainly because the oil prices have fallen,” which brings some good news that inflation may ease off a little, Naeem Aslam, chief market analyst at Ava Trade, said in a note.

Spot gold declined 1.7% to settle at $1,917.94 an ounce at 5pm a.m. in New York, after falling 1.9% Monday. Prices touched $2,070.44 last week, near the all-time high reached in August 2020. Silver and platinum fell.

A report Tuesday showed prices paid to U.S. producers rose strongly in February on higher costs of goods, underscoring inflationary pressures that set the stage for a Fed rate increase this week.

Palladium climbed as much as 5.2% after dropping 15% on Monday, the most since March 2020, as supply concerns eased. Vladimir Potanin, the biggest shareholder in key producer MMC Norilsk Nickel PJSC, said the company is maintaining exports despite the suspension of air links with Europe and the U.S. by re-routing shipments. The European Union exempted the metal from its latest set of penalties on Russian exports.

More stories like this are available on bloomberg.com.