By Olivia Rockeman

The U.S. added close to half a million jobs in March and the unemployment rate fell by more than expected, highlighting a robust labor market that’s likely to support aggressive Federal Reserve tightening in the coming months.

Nonfarm payrolls increased 431,000 last month after an upwardly revised 750,000 gain in February, a Labor Department report showed Friday. The unemployment rate fell to 3.6%, near its pre-pandemic low, and the labor force participation rate ticked up. Wage gains accelerated.

The median estimate in a Bloomberg survey of economists called for a 490,000 advance in payrolls and for the unemployment rate to fall to 3.7%.

Shorter-term Treasury yields rose and the dollar strengthened after the release on expectations that the data will bolster more hawkish Fed policy. The S&P 500 opened higher.

“This is an economy and labor markets overheating, the Fed has to accelerate” its tightening, Jeffrey Rosenberg, senior portfolio manager for systematic multi-strategy at BlackRock Inc., said on Bloomberg Television.

The data suggest that the labor market recovery is continuing at a robust pace as employers have better success filling a near-record number of positions. Inflation, shrinking excess household savings and solid wage growth are factors that could attract more Americans to jobs in the coming months. Covid has also become less of a factor as states broadly lift restrictions.

Fed officials, including Chair Jerome Powell, have said in recent weeks that they would support more aggressive monetary policy to curb decades-high inflation, including a possible 50-basis-point hike at the next policy meeting in May. Central bankers have repeatedly pointed to a strong labor market as one reason that the U.S. economy can handle a series of interest rate hikes that’s expected to extend into next year.

Wage Gains

Friday’s report showed average hourly earnings rose 0.4% from February and 5.6% from a year ago, the most since May 2020. However, inflation — at the highest since the early 1980s — is outpacing wage growth, effectively dealing a pay cut to many Americans and starting to dent consumer demand.

Despite the labor-market strength, President Joe Biden’s approval ratings from Americans have suffered due to the surge in inflation. Biden on Thursday announced that the U.S. would release a million barrels of oil a day from reserves for six months to help ease a spike in gasoline prices.

Biden touted the jobs report as a sign that his economic policies are working.

“People are making more money, they’re finding better jobs, and — after decades of being mistreated and paid too little — more and more American workers have real power now,” he said in remarks at the White House on Friday.

He also said that having more Americans at work is “going to help ease the supply pressures we’ve seen, and that’s good news for fighting inflation.”

Representative Kevin Brady of Texas, the top Republican on the House Ways and Means Committee, said that Americans should brace for higher prices ahead.

“There’s little relief for workers in March’s job report as job creation slows and inflation continues to rise. Wages just can’t keep up with President Biden’s raging inflation, which is accelerating.”

Leisure and hospitality accounted for a quarter of the payroll gains. Professional and business services, retail trade and education and health services also posted solid advances.

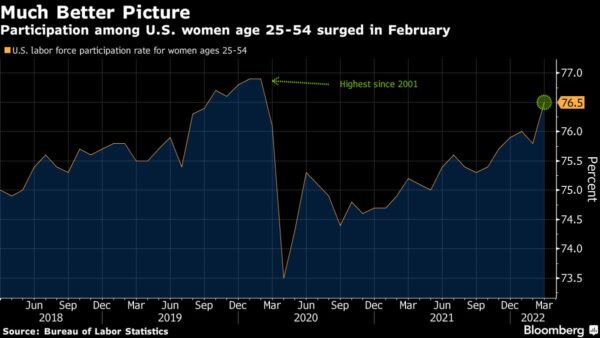

The labor force participation rate — the share of the population that is working or looking for work — edged higher to 62.4%, and the rate for so-called prime age workers, ages 25-54, rose to a two-year high.

The overall participation rate remains one percentage point lower than before the pandemic, due in part to lingering impacts including early retirements, shifting child care arrangements and public health concerns.

What Bloomberg Economics Says…

“With Covid cases down and services reopening, businesses can’t fill job openings fast enough. Workers’ improved wage-bargaining power, together with high inflation and dwindling excess household savings, create a powerful motivation to work.”– Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger, economists

However, as Covid cases broadly decline across the country, Americans are more encouraged to go back to work. The number of employed Americans not at work due to illness fell to the lowest since February 2020.

Unemployment rates fell broadly across all major demographic groups. Notably, participation for prime age women rose by the most since June 2020. The jobless rate for high school graduates without a college degree fell to the lowest since February 2020.

More stories like this are available on bloomberg.com.