By Paulina Cachero

As top firms shell out millions in the battle for Wall Street’s best and brightest, even interns are seeing their compensation soar.

Top global investment banks boosted intern pay by 37.2% for the current internship season from a year earlier, while other large banks are paying 36.9% more, according to finance career site Wall Street Oasis.

It’s been a particularly tough recruitment year for Wall Street. As many industries struggle to hire workers in a constricted labor market, the finance sector has simultaneously experienced high employee turnover and dissatisfaction among junior bankers who notoriously grind through 100-hour workweeks.

Traditional areas of banking are now finding themselves competing with hip tech companies that offer more casual and flexible workplaces and more lucrative finance shops like private equity firms. As the talent war hits a fever pitch, the banking industry is boosting interns’ pay to help bolster its entry-level pipeline.

Read more: Wall Street Bids Up Junior Banker Salaries in Battle for Talent

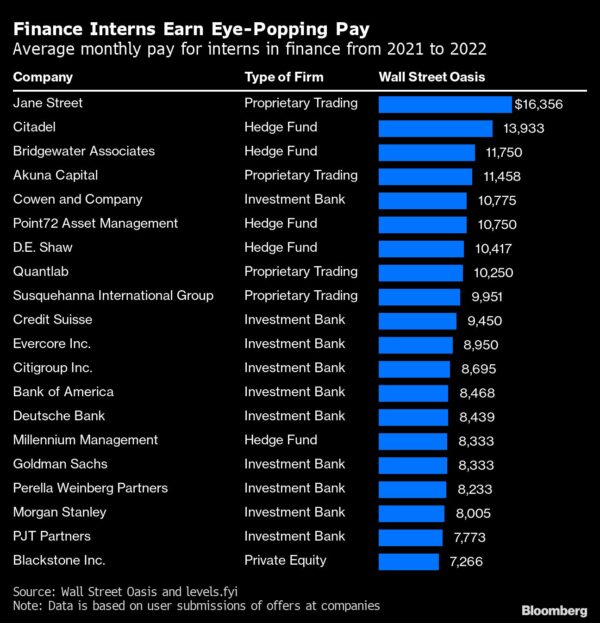

Wall Street Oasis founder Patrick Curtis said the growth in compensation for prospective junior bankers over the past year is the highest he’s seen since launching the company in 2006. And it’s not just the banks: interns at proprietary trading firm Jane Street are making an average salary of $16,356 a month — the equivalent of nearly $200,000 a year. Jane Street didn’t respond to a request for comment.

“These are record numbers for intern pay, especially what we are seeing in 2022,” Curtis said.

Hedge Funds

Hedge funds, high-frequency and proprietary trading firms topped the list for intern compensation, followed by investment banks, with the top eight paying a median salary above $10,000 a month, according to Wall Street Oasis. A typical internship at finance firms lasts anywhere from 10 to 12 weeks over the summer, although some offer extended training programs.

For the 0.8% of applicants who successfully secure an internship at top hedge fund Citadel, the median monthly pay is $14,000 or greater depending on the role — usually either a software engineer, trader or quantitative researcher, according to a spokesperson for the firm. Point72 Asset Management confirmed that the $10,750 monthly compensation was accurate for its 10-month investment analyst training program for upcoming graduates. Credit Suisse claimed the figures provided were inaccurate due to the fact that there are several variables that determine an intern’s pay, but wouldn’t confirm what its pay range is. The rest of the firms on the list declined to comment or have yet to respond to Bloomberg’s requests.

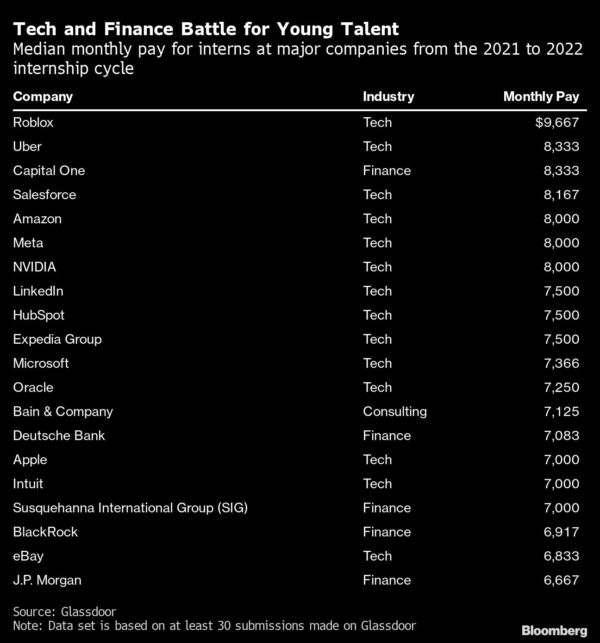

Curtis at Wall Street Oasis explained that firms usually determine compensation by how technical the role is, with quantitative trading and engineering internships usually paying the most. According to careers site Glassdoor, software engineering and investment banking analyst internships have the highest median pay at the companies it surveys. Location may also influence intern compensation, with positions in cities with high costs of living like New York or San Francisco often paying higher wages.

Unsurprisingly, interns pursuing advanced degrees also get a small leg up when it comes to pay. According to the National Association of Colleges and Employers, an intern studying finance in the first year of a master’s program earned an average of $31.47 per hour compared to $19.67 for undergraduate seniors and $21.34 for juniors during the 2019-20 academic year.

The crowdsourced data from both Glassdoor and Wall Street Oasis are based on user submissions from undergraduate and graduate students from 2021 to 2022. Wall Street Oasis primarily collects data on compensation in the finance sector, while Glassdoor collects data from major companies across several industries.

Silicon Valley

For years, Wall Street was the place to be for young and hungry new grads hoping to forge successful careers. Then, the financial industry’s reputation took a hit for its role in the subprime mortgage crisis and young recruits began flocking to buzzy Silicon Valley companies.

According to Glassdoor economist Lauren Thomas, the tech industry has solidified its place as a top spot for new talent in recent years. Two years ago, the tech industry represented less than half of the companies on Glassdoor’s highest-paying internship list. Now, Silicon Valley companies make up 68%.

“This shows how tech and finance industries are competing fiercely for talent and that competition for quality talent is only growing in today’s job market,” Thomas said.

Video-game platform Roblox Corp. topped Glassdoor’s list of the top-paying internships with a monthly salary of $9,667 a month. A spokesperson for Roblox said the company pays its interns $58 to $60 an hour.

But the tides may now be shifting as financial firms shell out as much as eight-figure pay packages for top talent, while big tech companies lose some of their luster as their stock prices fall. In 2021, the share of internships paying over $8,000 a month increased by 33% in finance and 22% in tech, according to Glassdoor data.

During the most recent intern recruitment cycle, savvy college students are showing signs that their sights may be set on Wall Street once again.

A record 236,000 people globally applied to Goldman Sachs’s highly competitive internship program, a 17% jump from 2021, Business Insider reported. Morgan Stanley also reported an increase in applications for the most recent internship cycle, but the bank did not confirm how many it received.

Curtis suggested that the surge in applications may be due to the unprecedented pay increase for junior bankers, who are now seeing six-figure offers to start. Earlier this month, UBS Group AG boosted salary for first-year analysts for the second time in less than a year to compete with Citigroup Inc. and JPMorgan Chase & Co., which set the new standard pay for junior bankers at $110,000 a year.

Still, he thinks Silicon Valley retains the power to lure talent away from Wall Street.

“I’ve never seen such an acceleration in pay for junior investment bankers in such a short period of time,” Curtis said. “But a dramatic rise in pay isn’t enough to stop the attrition and the brain drain to Silicon Valley.”

More stories like this are available on bloomberg.com.