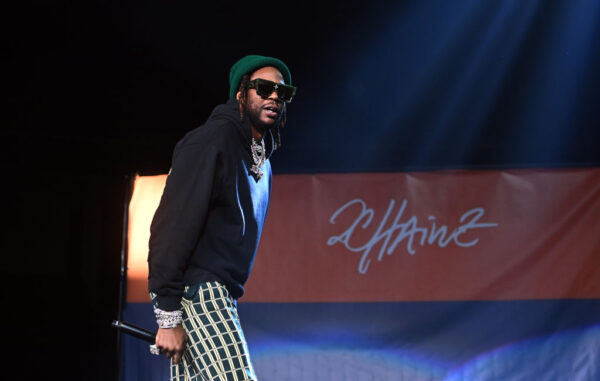

Hip-hop artist 2 Chainz has not only established himself in the music business, the platinum-selling rapper has also proved himself to be a astute investor. With several successful investments in his portfolio, he now says he is considering opening his own venture capital fund.

He pondered the idea in an instagram series of stories shared on his account on April 19.

Venture capital funds are pooled investment funds that manage the money of investors who want to take private equity stakes in startups and small- to medium-sized enterprises. Black-owned funds lag in the sector. In 2021, of the 627 women- and minority-led firms, only 84 were Black-owned.

“So this Instacart, most of y’all know about it,” 2 Chainz said after showing fans the groceries he received from the delivery app and revealing he was an Instacart investor. “I invested in Instacart a while back. You know I’m a part of a few funds, VC funds, private equity stuff that I’m seriously thinking about starting my own fund where I can connect the dots be the bridge between people that don’t get these opportunities that I be getting, right?”

He continued, “So let me know if I did something in the private equity field would you be interested in trusting me? Even if you don’t, I’m still like rich or whatever. I have a lot of these opportunities I’m investing in a lot of stuff, and yeah.”

2 Chainz, who host the TV show “Most Expensivest” about how the wealthy spend their money, has a wide array of investments. He and fellow hip-hop artist Juicy J invested in Heliogen, a $2 billion solar energy merger, in 2021. 2 Chainz has also previously invested in Escobar Restaurant & Tapas, a nail salon called Pamper, an after-hours club called Members Only, a cannabis line, and two properties in Las Vegas, among other businesses.

He has also tried to help young founders. In 2020, he teamed up with YouTube for a five-part series called Money Maker Fund, inspired by his 2020 single “Money Maker.” Sort of a “Shark Tank” for HBCU students and alumni, in the series he fielded business pitches and invested $55,000 into the the ideas he thought most viable.