By David Pan

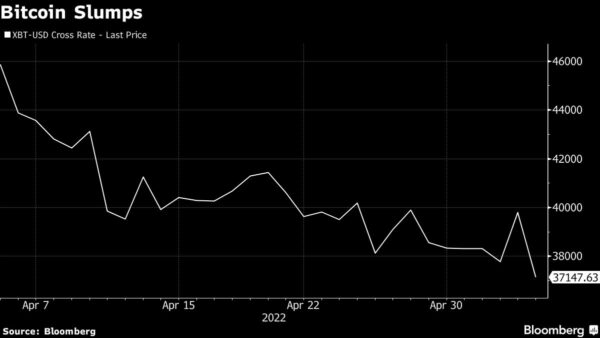

Bitcoin dropped the most in almost a month as the optimism seen across financial markets following the Federal Reserve’s meeting on Wednesday faded.

The largest digital currency fell as much as 8% to $36,639, the biggest intraday drop since April 11. It had gained 5.3% on Wednesday. Ether slumped as much as 7.2%. Avalanche and Solana, among some of the largest gainers after the U.S. central bank raised rates Wednesday, were down as much as 11% and 7.3%, respectively.

“The market still needs to digest the impact of tighter monetary policy on all risk assets and crypto might take a hit as correlations” with U.S. stocks increase, said Josh Lim, head of derivatives of New York-based brokerage Genesis Global Trading.

The U.S. central bank’s policy-making Federal Open Market Committee on Wednesday voted unanimously to increase the benchmark rate by a half percentage point and said it will begin allowing its holdings of Treasuries and mortgage-backed securities to roll off in June. Risky assets surged after Fed Chair Jerome Powell said a 75-basis point increase is “not something that the committee is actively considering.”

Still, in this higher-rate environment, Bitcoin hasn’t been able to break out in any meaningful way beyond its highs at the start of the year. The coin has largely traded within a tight range over the past few months.

The “technical picture in BTC remains poor, in spite of a less hawkish Powell, BTC failed to regain 40,000, hence this pull back.” said Teong Hng, chief executive of Hong Kong-based crypto investment firm Satori Research. “As equity markets in U.S. reversing yesterday’s gains, crypto follows suit.”

Money has been flowing out of the sector amid the malaise. Investors yanked roughly $120 million from crypto products last week, bringing total outflows over the past four weeks to $339 million, according to data tracked by fund provider CoinShares. Bitcoin last week accounted for the majority of the flows in what was its largest single week of outflows since June 2021.

(Updates prices. An earlier message corrected the percentage move in the second paragraph.)

More stories like this are available on bloomberg.com