By Liana Baker, Davide Scigliuzzo and Kamaron Leach

Buyout firm Vista Equity Partners agreed to acquire tax-management software provider Avalara Inc. for $8.4 billion including debt.

Vista will purchase Seattle-based Avalara for $93.50 per share in cash, according to a statement Monday, which confirmed an earlier Bloomberg News report. The offer represents a 27% premium to Avalara’s closing price on July 6, the last trading day before news of a potential transaction first emerged.

Private equity has been aggressively going after technology companies, which have seen their valuations plummet amid a broader market selloff in recent months.

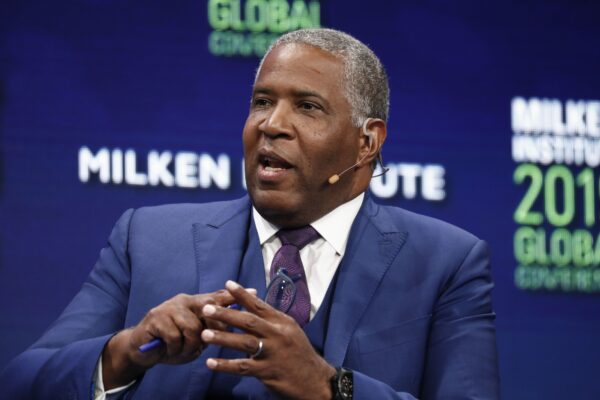

Led by billionaire Robert F. Smith, Vista invests in enterprise software and related businesses. The firm has raised more than $10 billion in capital for its eighth buyout fund as of July, according to a person familiar with the matter.

“Avalara is a mission-critical platform serving customers in a variety of end-markets, including retail, manufacturing, hospitality, and software,” Vista Managing Director Adrian Alonso said in the statement.

Cloud Platform

Vista started the year by joining with Elliott Investment Management to buy software maker Citrix Systems Inc. in January for $13 billion. In April, Vista agreed to sell its majority stake in software maker Datto Holding Corp. to Kaseya Ltd. in a deal valued at about $6.2 billion. Also that month, SecureLink, in which Vista was an investor, was bought by Imprivata.

In May, Vista sold a minority stake in software company iCIMS to TA Associates. Vista, which holds about a 9.7% stake in Ping Identity Holding Corp., is currently backing that company’s sale to Thoma Bravo.

Avalara’s cloud-based services help businesses maintain tax compliance, according to its website. It raised $207 million including so-called greenshoe shares in its 2018 initial public offering.

“We are pleased to partner with Vista and will benefit from their expertise in enterprise software as we build and improve upon our cloud compliance platform,” Scott McFarlane, Avalara’s co-founder and chief executive officer, said in Monday’s statement.

Vista’s purchase is expected to close in the second half of the year, pending shareholder approval and regulatory clearance, according to the statement. The company will continue to operate under the Avalara brand after the deal, which isn’t subject to any financing conditions.

Goldman Sachs Group Inc. advised Avalara on the sale.

More stories like this are available on bloomberg.com.