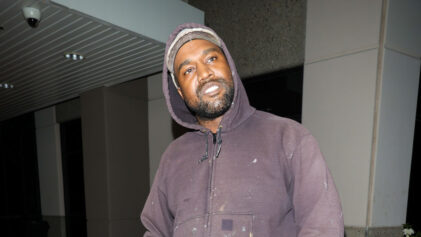

A Seattle couple has joined the growing list of Black American homeowners who have participated in “whitewashing” their property during the appraisal process to receive a higher home value.

Four years ago, the Clarks purchased their home and began renovating immediately. A fixer-upper in the Columbia City section of Seattle, the couple saw it as a good buy that would increase in value with the right renovations.

“The homes are selling for over a million dollars here,” Joe Clark told King5. “We bought this house kind of under — it was under duress.”

Renovations included renovating the kitchen and bathroom. The couple also added an extra bathroom and have plans to expand the second floor.

By April of this year, the Clarks wanted to explore financing further renovations and requested an appraisal. In the early months of 2022, Seattle real estate prices soared. The average home price was in their neighborhood was $900,000, a 10 percent increase from 2021.

To their surprise, the home was valued at $670,000, a decrease from its original price.

“It was quite amazing to have an appraisal that low in this market,” Clark told King5. The homeowner recalled a conversation with a real estate agent saying, [My agent] asked me, ‘How was the appraisal?’ I said, ‘It came in really low.’ ‘Oh, because it was $800,000-$900,000?’ and I’m like, ‘No, no, it was in the sixes.’”

A White Neighbor Steps In

Clark fet this appraisal was biased. And so, after speaking with a white neighbor, Marta Eull, the couple decided to request a second appraisal. This time, however, they “whitewashed” their home, erasing any trace that a Black family lived and owned the property. The Clarks replaced photographs of their family members and anything showing that a Black American family owned the family.

“The objective was to see if you had a person that was not someone of color in the house … if that would change the amount that he got for the appraisal to see if there was some kind of bias there,” Eull told King5.

Their experiment proved correct–the second appraisal was $259,000 higher than the first and their home was valued at $929,000.

“We’re talking a three-week period, and nothing else changed in the house outside of me,” said Clark. “I just want to make sure that we get the fair market value for the home.”

Appraisal Discrimination

The concept of “whitewashing” during the appraisal process is not new but rather a reflection of discrimination within the real estate industry.

“The larger issue is Black homeowners’ lack of trust in the appraisal process. If you look at the Appraisal Foundation, which is our governing body, and you look at the Uniform Standards of Professional Appraisal Practice, which are the rules that appraisers must follow, all of those things are built on being unbiased, impartial, fair, and the public and consumers trusting that appraisers are unbiased and impartial,” Jessica Brown, an appraisal trainee with Treffer Appraisal Group in Annapolis, Maryland, and a consultant with Area Probe, a national real estate consultancy, told Bankrate.com. “If any segment of the general public is lacking trust in the appraisal profession, whitewashing is the type of thing that you’re going to see.

In towns throughout the United States, black homeowners have reported appraisal discrimination.

This past August, a couple in Baltimore filed a housing discrimination lawsuit in Maryland District County against LoanDepot and an appraiser for its valuation of their property at less than $500,000. When a white coworker stepped in for the second appraisal, the property’s value rose to $750,000.

The lawsuit, filed by Dr. Nathan Connolly and his wife, Dr. Shani Mott, both professors at John Hopkins University, argues that 97 percent of home appraisers in the United States are white, which creates concerns of bias and systemic racism.

And that’s not all.

Other lawsuits — stretching from California to Illinois to Maryland — have spurred the launching of the Interagency Task Force on Property Appraisal and Valuation Equity. Spearheaded by HUD Secretary Marcia Fudge and former National Security Advisor Susan Rice, the initiative’s mission is to evaluate appraisal bias and develop plans to shift the industry.

“It is a part of our systematic racism that is here in America but we need to do something about it. It’s taking away our generational wealth,” Clark told King5.