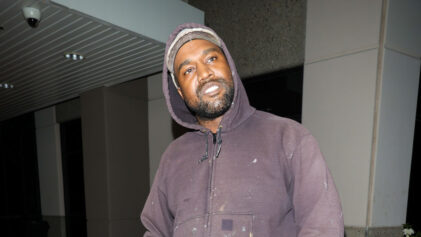

Bitcoin may be a much more volatile investment than traditional stocks, but hip-hop artist Snoop Dogg believes that having a positive outlook and remaining confident will always allow investors to reap its long-term benefits.

“…every great industry has a downfall, and there’s always a depression in every industry. You could look at Alcohol, tobacco, clothing, and food,” Snoop Dogg told CNBC in an interview. “(it’s) a beautiful industry.”

In June 2022, Bitcoin experienced a strong crash–the worst since September 2011 with the BTC price falling below $20,000. Just one year before BTC had peaked at $68,000

Snoop Dogg, who has a net worth of $150 million, has long been an advocate of cryptocurrency and has even sold albums through BTC. According to Business Insider, it is anticipated that he has earned more than $1,000 per album through Bitcoin value. Snoop Dogg spoke in support of the industry, an uptick was present in Bitcoin. According to Benzinga Pro, if someone invested $100 in Bitcoin after hearing Snoop Dogg’s articulation of the industry would have gained 50.27 percent or $150.27.

By August 2022, Bitcoin’s value began to rise again. Since then it has grown by 10 percent and represents 51 percent of the crypto market value, according to The Motley Fool. The rise in price came as investors shifted from more volatile altcoins for the reliability of Bitcoin.

“I just feel like this ‘weeded’ out all of the people that weren’t supposed to be in that space and all the people who were abusing the opportunities that were there,” Snoop told CNBC. “Now, it’s going to bring great business, and moving forward the market will have great things to pick and choose from.”

Insight on Investing In Bitcoin

Although Bitcoin is considered a resilient investment option amongst altcoints, it is still much more risky than traditional stocks.

“Cryptocurrency is speculative, completely based on supply and demand,” David Stein, former chief investment strategist and portfolio manager told The Balance. “All currencies are, to some degree, based on what people are willing to pay, but it’s different with a crypto like Bitcoin. Unlike other currencies like the dollar or gold, it’s a much smaller market with regard to its overall size, so it’s more subject to big swings.”

Considering that Bitcoin does not possess predictors of traditional stocks, and that it is a developing industry, investors should use Bitcoin to diversify their portfolios. However, it should not be the touchpoint of your investment strategy.

“Bitcoin is helpful if you want to have some assets that aren’t denominated in the dollar or other home currency,” Stein said. “It’s a way to hold some assets away from the dollar.”