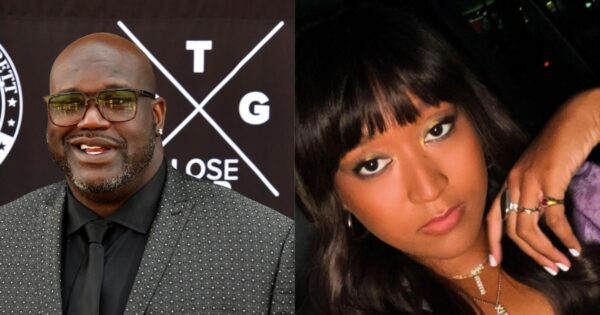

A court document that was recently released reveals how much money Shaquille O’Neal and Naomi Osaka profited from promoting the failed and controversial cryptocurrency exchange FTX.

Following the bankruptcy filing, FTX, led by Sam Bankman-Fried, brought in financial advisers from Alvarez & Marsal Holdings. Their task is to scrutinize disbursements made to athletes like Shaq and Osaka, aiming to navigate a recovery within the framework of Chapter 11 bankruptcy regulations.

Shaq has a net worth of $400 million, while Osaka has a reported net worth of $45 million, with Forbes reporting that she was the highest-paid female athlete in 2022, earning more than $51 million that year.

The assessment focuses on transactions conducted immediately before the company’s Nov. 11, 2022, bankruptcy filing.

Who Got What

According to court papers as reported by Bloomberg, FTX paid Shaq $4.3 million and Osaka $3.2 million for partnerships. Osaka received $2 million two days before the company declared bankruptcy.

FTX’s disclosures reveal that Shaq and Osaka are just two of many entities that received payments, including sports leagues, teams, and celebrated athletes who operate organizations.

For example, Major League Baseball received around $4.9 million for umpires wearing FTX logo patches, the NBA’s Golden State Warriors received $3.4 million, NFL player Trevor Lawrence was given $500,000 in September 2022, retired Boston Red Sox player David Ortiz got approximately $600,000 for his charity supporting children’s heart surgeries, and Stephen Curry’s business, SC30 Inc., also received nearly $242,000.

FTX Backstory

In early January 2022, FTX was valued at an impressive $32 billion and had secured $400 million in investments from Japanese-based Softbank Group, alongside contributions from international investors like Singapore’s Temasek Holdings and the Ontario Teachers’ Pension Plan Board.

The rapid success was driven by significant venture capital support, reflecting the cryptocurrency industry’s growing appeal during the COVID-19 pandemic, according to The New York Post.

However, on Nov. 15, 2022, a class-action lawsuit alleged that FTX and Bankman-Fried and celebrities violated Florida law, misled customers, and caused substantial financial losses to investors.

Bankman-Fried was arrested in the Bahamas on Dec. 12, 2022, after U.S. prosecutors filed criminal charges. He was later extradited to the United States. FTX allowed customers to trade digital currencies for other digital or traditional money, and it had its own cryptocurrency called FTT. Operating from the Bahamas, FTX focused on risky trading options not allowed in the U.S.

What caused FTX’s downfall was when Changpeng Zhao, CEO of Binance, the world’s largest crypto exchange, sold his FTX stake back to Bankman-Fried, receiving FTT tokens in return. This move led to concerns about FTX’s financial stability. As a result, FTT prices fell, causing panic among investors who hurried to withdraw their funds. FTX faced an $8 billion deficit, and although Binance initially offered a loan to help, they later withdrew their support, ultimately pushing FTX to file for bankruptcy on Nov. 11, according to The New York Times.

FTX’s collapse triggered investigations by the Justice Department and the Securities and Exchange Commission (SEC), which are looking into whether FTX misused customer funds to support Alameda Research, a crypto trading platform co-founded by Bankman-Fried.

Fast-forward to September 2023, and Bankman-Fried is in the Metropolitan Detention Center in Brooklyn awaiting an upcoming pretrial hearing on Oct. 3 for fraud charges linked to FTX’s collapse, which will take place in the Southern District of New York, according to Reuters.

He has been in jail since Aug. 11, and on Sept. 12 his bail bid was denied.