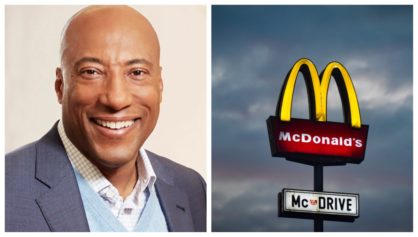

Over the past three decades Byron Allen has emerged as a prominent figure in the realm of media moguls, but not without enduring a series of hardships.

Embarking on his entertainment career at the age of 14 with a start in stand-up comedy, Allen, now 62, laid the foundation for what would evolve into the Allen Media Group in 1993. However, a plethora of financial challenges marked this path, which Allen has spoken candidly about in previous interviews.

“When I started calling stations from my dining room table, asking them to carry my weekly television show for free, I had to work through about 50,000 noes to get the 150 yeses that became my lineup,” he revealed to Variety in an interview published on Dec. 17.

But even through adversity and difficulties with securing advertisers for national slots, Allen has managed to amass a portfolio of networks in cash acquisition deals. Variety reports Allen Media now owns 10 cable networks, including notable ones such as The Weather Channel, JusticeCentral.TV, Cars.TV, and Pets.TV. Allen asserted to the outlet that Allen Media Group stands as the “largest provider of first-run syndicated shows for broadcast stations,” totaling over 70.

Allen made headlines with his ambitious $10 billion bid for ABC and other Disney networks, a move that underscored his stature as a bold player in the media landscape. This year sought to expand his influence by venturing into the acquisition of one of the entertainment industry’s giants, including a failed offer to acquire BET that actor-director Tyler Perry and music mogul Sean “Diddy” Combs were suitors for.

And, on Dec. 20, Byron started the bidding process again for BET. He emailed Paramount Global’s senior executives and board members. In the email, Allen proposed an impressive $3.5 billion acquisition deal for BET Media Group, encompassing assets such as the BET cable channel, VH1, BET Studios, and the streaming service BET+. This new offer marks an increase from Allen’s previous bid of $2.7 billion earlier in 2023, sources with knowledge of the situation told Variety.

Alongside the challenge of assembling his lineup, Allen confronted difficulties in securing advertisers for his national slots, resulting in financial hardships in his personal life.

“My home went in and out of foreclosure many times over a five-year period,” he reminisced. “My phone would get shut off, and I’d be calling people from pay phones.”

Confronting challenges head-on ultimately led to the successful revenue model of allowing each network to license his shows for free, in exchange for retaining the right to sell 50 percent of the advertising directly.

Looking ahead, Allen said he envisions the future of his company as marked by the expansion of “organic” and “strategic acquisitions” to fulfill his overarching mission.

“I haven’t yet done what I set out to do — we’re tiny, and while we’re growing exponentially, we’re still in our infancy,” Allen remarked. “The goal is to build the world’s biggest media company and use it to effect change for the greater good.”