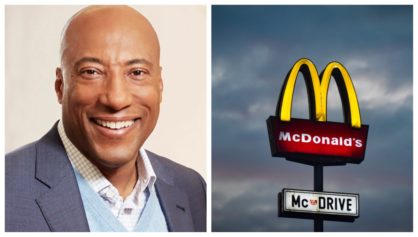

Media mogul Byron Allen is making headlines once again with a whopping $14.3 billion offer to acquire all outstanding shares of Paramount Global. This latest bid, representing a 50% premium to recent trading prices, is part of Allen’s ongoing pursuit of major media assets.

This follows Allen’s bid last year for Paramount’s BET and VHF channels.

Allen’s offer, which includes $28.58 per voting share and $21.53 per non-voting share, seeks to take control of Paramount. With existing debt factored in, the total deal value reaches approximately $30 billion, according to Bloomberg.

Billions Offered

“This $30 billion offer, which includes debt and equity, is the best solution for all of the Paramount Global shareholders, and the bid should be taken seriously and pursued,” Allen’s company said in the statement to Bloomberg.

Allen made his offer through text message and email to Paramount senior management and board members.

Despite the substantial offer, some are skeptical about Allen’s proposal as some doubt Allen’s ability to finance the deal raises questions, CNBC reported.

“We have more than enough capital available to us. The real challenge is certainty of close,” Allen told CNBC. “This deal lives or dies at the [Federal Communications Commission].”

Still, he has a history of ambitious bids in the media sector. From attempting to acquire E.W. Scripps Co. television stations to making a $10 billion offer for Walt Disney Co.’s ABC TV network and other channels to trying to purchase majority interest in BET, Allen has consistently pursued strategic acquisitions.

Allen’s plan for Paramount involves divesting certain assets, including the film studio and real estate, while retaining the TV channels, notably the Paramount+ streaming service, for more cost-efficient management. He has reportedly secured interest from banks and investors to support the acquisition.

Paramount, the parent company of CBS, Nickelodeon, and other channels, has been the subject of acquisition discussions for some time.

After Allen’s bid, Paramount’s non-voting shares experienced a 22 percent surge in premarket trading following the announcement but stayed below the offer price.

Paramount’s Paramount+ streaming service has seen growth, with subscriber numbers reaching 63 million.

Allen: From Comic to Media Titan

Allen has come a long way since his stand-up comic days in the late 1970s. By 1993 he had launched a production company, CF Entertainment, devoted to producing low-cost non-fiction television programming. Allen has spent more than $1 billion in building his media assets that include The Weather Channel and a roundup of local TV stations from Honolulu to Tucson. His personal net worth is around $735 million, according to Bloomberg estimates. According to Allen Media Group’s website, the company has annualized revenue estimated at $600 million and 1,300 employees.