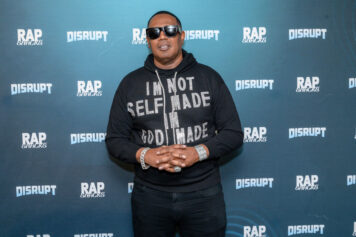

Percy Robert Miller, famously known as Master P, forged an unparalleled entrepreneurial legacy that sprouted from an unexpected source: a $10,000 life insurance policy.

At the age of 19, he received a check from a life insurance policy valued at $10,000 after his grandfather’s passing. The iconic rapper’s journey to success didn’t follow the conventional trajectory. Instead of safeguarding the windfall for personal security, Master P, a New Orleans native, saw an opportunity to turn this sum into a catalyst for his entrepreneurial dreams.

“My grandparents were real wise when it came down to insurance. They always used to tell me to put [my] money into insurance, rather than a bank. The bank going to take your money and get 15% on insurance buying,” he said during a live interview for the 7 Figure Squad.

In 1990, Master P ventured into the music industry, using the insurance payout to open a record store named No Limit Records, which laid the groundwork for his independent record label of the same name. This bold move allowed him to produce and distribute music, launching a platform that not only elevated his career but also reshaped the hip-hop landscape.

No Limit Records became a powerhouse, signing influential artists such as Snoop Dogg, Mystikal, and Mia X. Master P’s business acumen and strategic signings propelled the label to remarkable success, challenging industry norms and carving its niche in the music world.

However, his vision extended far beyond music. Master P diversified his business ventures, delving into clothing lines, film production, and sports management. The launch of “Make ‘Em Say Uhh!” energy drink showcased his versatility, expanding his brand into different markets and solidifying his presence as a multifaceted entrepreneur.

Master P’s long-time relationship with Snoop Dogg expanded their collaborative efforts into uncharted territories, such as consumer products. One of their notable ventures emerged in the form of a joint foray into the cereal market. Their latest venture, the “Snoop Cereal,” targeted children’s breakfast preferences. Emphasizing the significance of establishing a Black-owned family brand, Master P highlighted that their vision extends far beyond a mere cereal product. He aimed to create a brand identity that resonates with families, transcending the breakfast aisle to symbolize a broader ethos of cultural representation and empowerment.

Beyond his entrepreneurial pursuits, Master P became a vocal advocate for financial literacy, particularly within underserved communities. His commitment to empowering aspiring entrepreneurs through education and mentorship underscores his belief in giving back and fostering future business leaders.

Life Insurance as an investable asset

According to several studies, Black Americans tend not to look as life insurance as a way to pass on wealth, as did Master P’s grandfather. Black insurance policy holders tend to use the policy to pay for burial expenses, but that is changing as many Black insurance policy holders are using insurance as an asset and a wealth building tool.

Insurance, often perceived solely as a protective measure, holds untapped potential as a strategic asset in financial planning. Beyond its traditional role in safeguarding against unforeseen risks, insurance can be leveraged as a valuable asset within a diversified portfolio. Policies like whole life or permanent insurance accumulate cash value over time, presenting opportunities for wealth accumulation and financial growth.

Rapper Waka Flocka Flame also recognized the potential of whole life insurance as an investable asset. The hip-hop phenom openly discussed his financial acumen on TikTok, citing whole life insurance as a key element of his investment strategy. By leveraging its cash value, he has utilized this insurance policy as a means of building wealth and securing his financial future.

Similarly, the visionary entrepreneur Walt Disney utilized whole life insurance to safeguard and grow his wealth. Disney’s strategic use of insurance not only provided security but also served as a tool for accumulating capital, aiding in funding his ambitious projects, including Disneyland.

Both instances underscore how these influential figures recognized the enduring value of whole life insurance as a smart investment asset, leveraging its benefits to secure their financial legacies.